The Polish Midwife Who Delivered 3000 Babies at Auschwitz

Fifty years ago died one of the most remarkable women of the 20th century. You have probably never heard of Stanistawa Leszczynska. Few people have. Yet she was a model of heroism and humanity who should be acclaimed around the globe.

Keep readingThe Importance of Hope

I am a great believer in hope. In fact, I think of myself as a rather hopeful person. Despite a world that often feels like it has gone mad, and my writing op-eds highlighting all the various problems and inconsistencies around us, I remain optimistic and hopeful.

Keep readingWhat Iran Didn’t Win

The response of some Gulf states to Iran’s attack is ominous for its plans for regional hegemony.

Keep readingWhy AI Chatbots Have a Free Speech Problem

Google recently made headlines globally because its chatbot Gemini generated images of people of color instead of white people in historical settings that featured white people. Adobe Firefly’s image creation tool saw similar issues. This led some commentators to complain that AI had gone “woke.” Others suggested these issues resulted from faulty efforts to fight…

Keep readingThe BFD General Debate

Good morning, welcome to our daily General Debate. On General debate, you are encouraged as a commenter to share your own stories, discuss other news, bring NEW news, catch up with friends or make new friends with other commenters. To participate you’ll need to sign up for a Disqus account which is free, quick, and…

Keep readingJapan Is Going to the Moon

The new Moon race is just as political as the last one.

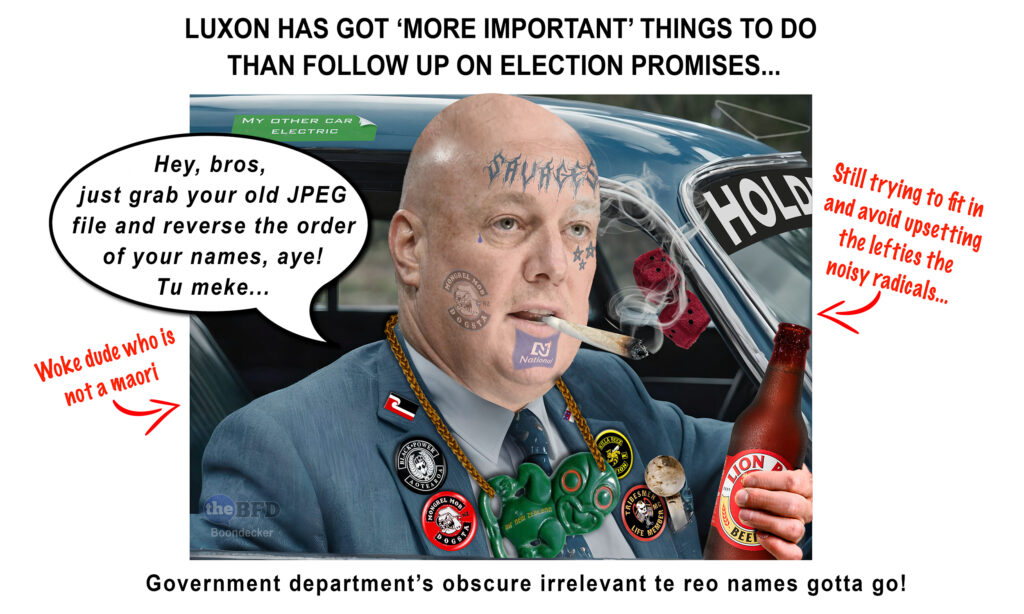

Keep readingAnti-establishment Feeling Is Rising From Both Sides

Serious discontent is bubbling away – especially on the left and amongst low-income and Maori.

Keep readingShould You Watch the Movie ‘Civil War’?

This organization’s outlined ambitions provide valuable context for discussing the movie “Civil War,” with a perspective notably absent in any reviews I’ve encountered so far. However, it’s worth noting that most reviewers contribute to the very issue I’ll discuss; how many of us trust “MSM movie reviewers” these days?

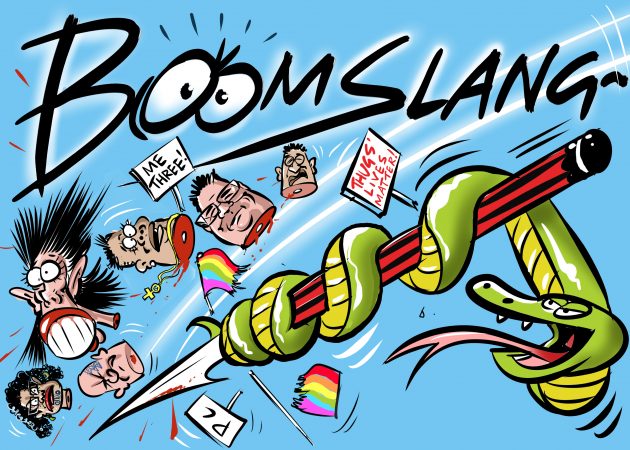

Keep readingWhat Is Killing the MSM

Legacy media no longer controls the medium: it is the independents that create the message because content is king and they produce it.

Keep readingA Rising New World

The conservative of the modern era is a new type of nationalist populist conservative. One that recognises and respects the traditions of other civilizations and is…

Keep readingEnding the Quest

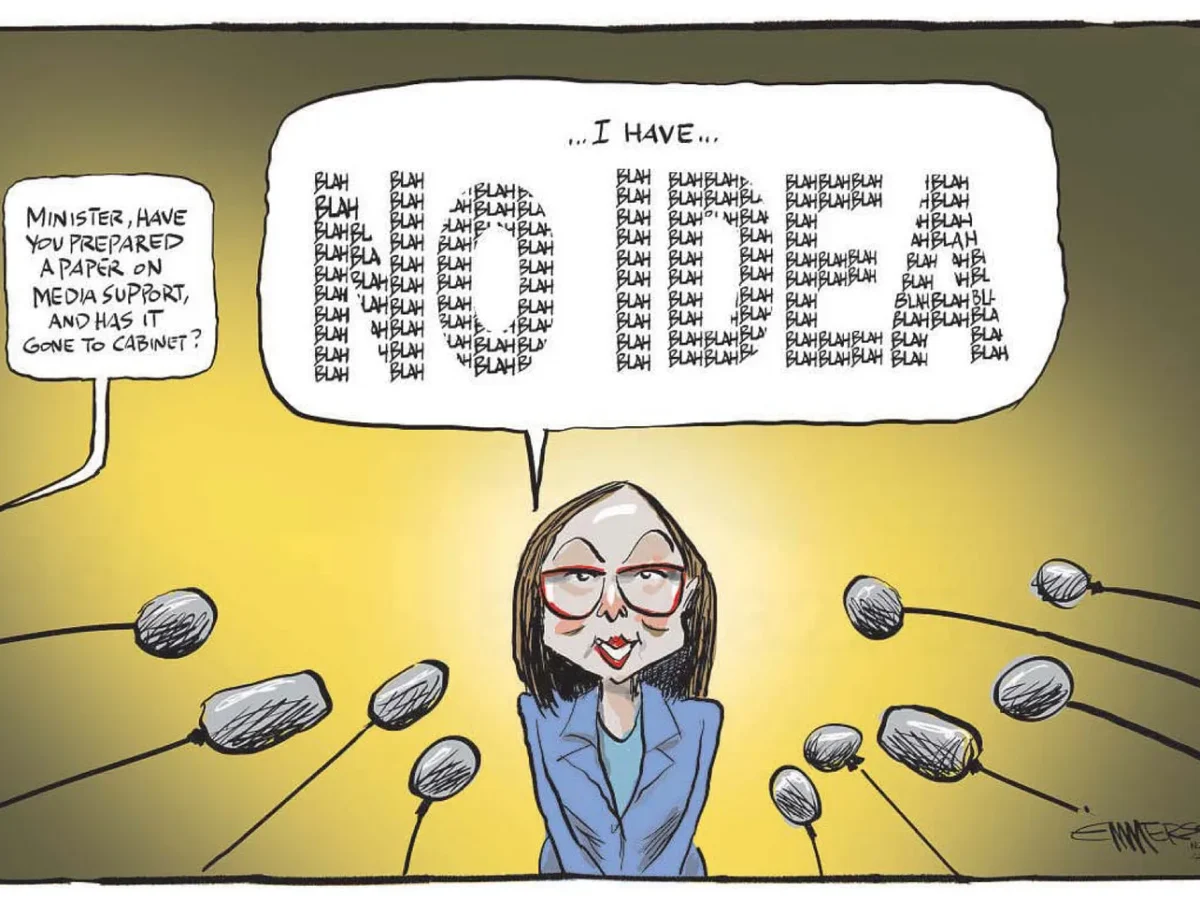

MELISSA LEE should be deprived of her ministerial warrant. Her handling – or non-handling – of the crisis engulfing the New Zealand news media has been woeful. The…

Keep readingWould Helen Clark Please Just STFU

Most Kiwis prefer their past Prime Ministers to either be dead or silent, but since Helen Clark shuffled off in ignominy in 2008 after being trounced in the…

Keep readingBritish MPs Banned but Iranian Mayors Are Celebrated

The United Kingdom has allowed Islam to infiltrate British history and culture. It is the European left that has facilitated the expansion of Islamism across the continent this…

Keep readingFace of the Day

When Jahden Nelson went to work on Tuesday, April 19, 2022, he had no idea the day would end with him fighting for his life in hospital.

Keep readingThe BFD Nightcap

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingFriday Fur

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep reading