The BFD News Quiz

Are you an avid reader of The BFD? Take our News quiz to find out how much information you can recall from our articles published this week.

Keep readingThe Increase in Cancer Deaths

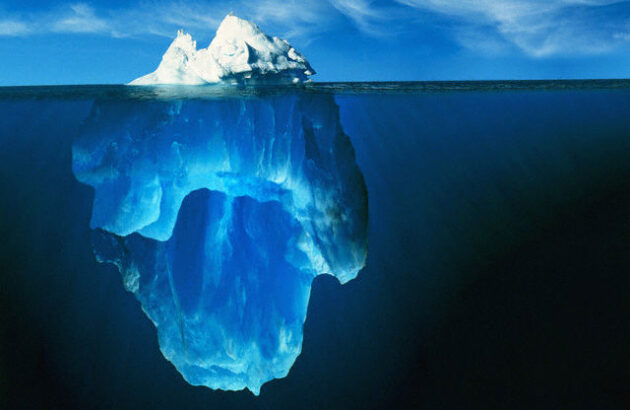

Whilst reduced cancer screening and care due to lockdown may explain increased cancer deaths, clearly it does not explain why six specific types of cancer increased with statistical significance in 2021, and even further in 2022. These were ovarian cancer, leukemia, prostate, lip/oral/pharyngeal, pancreatic, and breast cancer.

Keep readingThe BFD Daily Opinion Poll

Take our Daily Opinion Poll and see how your views compare to other readers and then share the poll on social media.

Keep readingBecoming an Orphan as an Adult

The finality of losing a parent is difficult to comprehend. Your parents (or parent) have always been there; a part of your life. Your Dad and/or your Mum have been alive and present in the living world since you can recall your first memory.

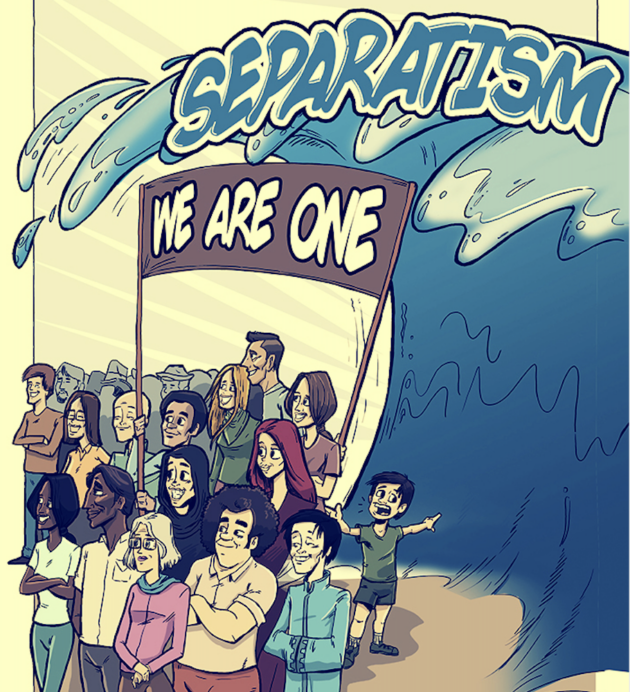

Keep readingDoes Culture Matter More Than Care?

One of reasons Oranga Tamariki exists is to prevent child neglect. But could the organisation itself be guilty of the same?

Keep readingThe BFD General Debate

Good morning, welcome to our daily General Debate. On General debate, you are encouraged as a commenter to share your own stories, discuss other news, bring NEW news, catch up with friends or make new friends with other commenters. To participate you’ll need to sign up for a Disqus account which is free, quick, and…

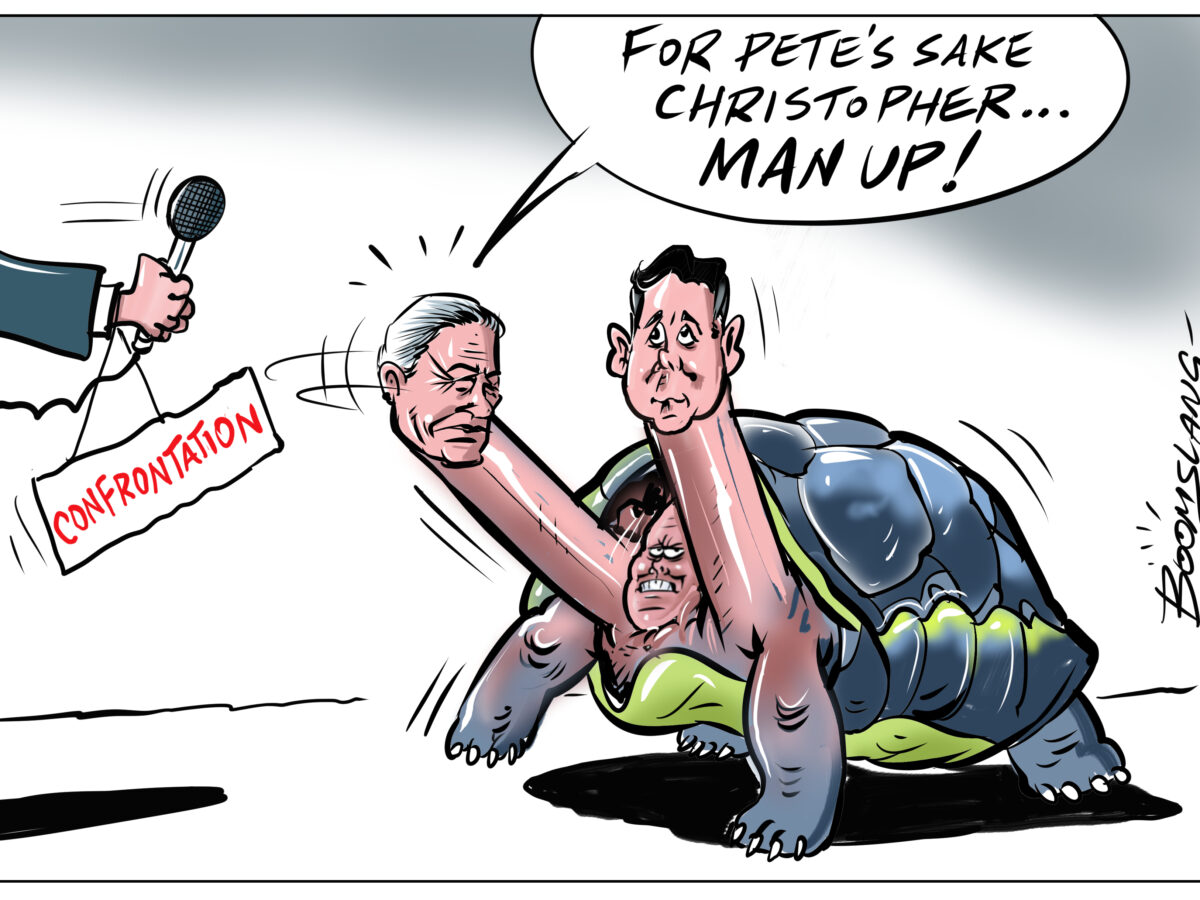

Keep readingLuxon Needs to Wake Up

Both Melissa Lee and Penny Simmonds have been stitched up by officials whispering in the ear of the Prime Minister, who naively assumes people are telling him the truth.

Keep readingLuxon’s Show of Strength Is Perfect for Our Era

Removing ministers for poor performance after only five months in the job just doesn’t normally happen in politics.

Keep readingMake Your Mind up Willie

Willie Jackson is a motor mouth with a poor memory. Just a few weeks ago he was attacking Melissa Lee and calling her ‘useless’, ‘stupid’ and ‘incompetent’, and yesterday he was waxing lyrical about her skill set after Christopher Luxon sacked her as Broadcasting Minister. Make your mind up Willie!

Keep readingThe 1950s Queen St Parking Protest

By 8 am Auckland was in gridlock. At 9 am when most retailers would open, Queen St was in turmoil without those parking spaces. Most motorists…

Keep readingWant More Traffic to Your Blog?

If you have a strong desire to be involved in growing your own audience by joining an already very popular New Media site, contact us now.…

Keep readingFaces of the Day

A supermarket built to plug the “massive hole” in one of the most deprived communities in Hamilton is nearly set to open its doors.

Keep readingThe BFD Daily Proverb

A stone is heavy and sand is weighty, but the resentment caused by a fool is even heavier.

Keep readingThe BFD Nightcap

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingFriday Fur

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingPatrol Dog Havoc in the Air

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingReproducing a 400,000 Year Old Hand Axe from a Giant Flint Stone

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep reading‘Esafety Expert’ Caught Out Lying Live on Air

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep reading