Should You Watch the Movie ‘Civil War’?

This organization’s outlined ambitions provide valuable context for discussing the movie “Civil War,” with a perspective notably absent in any reviews I’ve encountered so far. However, it’s worth noting that most reviewers contribute to the very issue I’ll discuss; how many of us trust “MSM movie reviewers” these days?

Keep readingWhat Is Killing the MSM

Legacy media no longer controls the medium: it is the independents that create the message because content is king and they produce it.

Keep readingA Rising New World

The conservative of the modern era is a new type of nationalist populist conservative. One that recognises and respects the traditions of other civilizations and is willing to allow other societies to practice their traditions and customs in return for the same accommodation.

Keep readingEnding the Quest

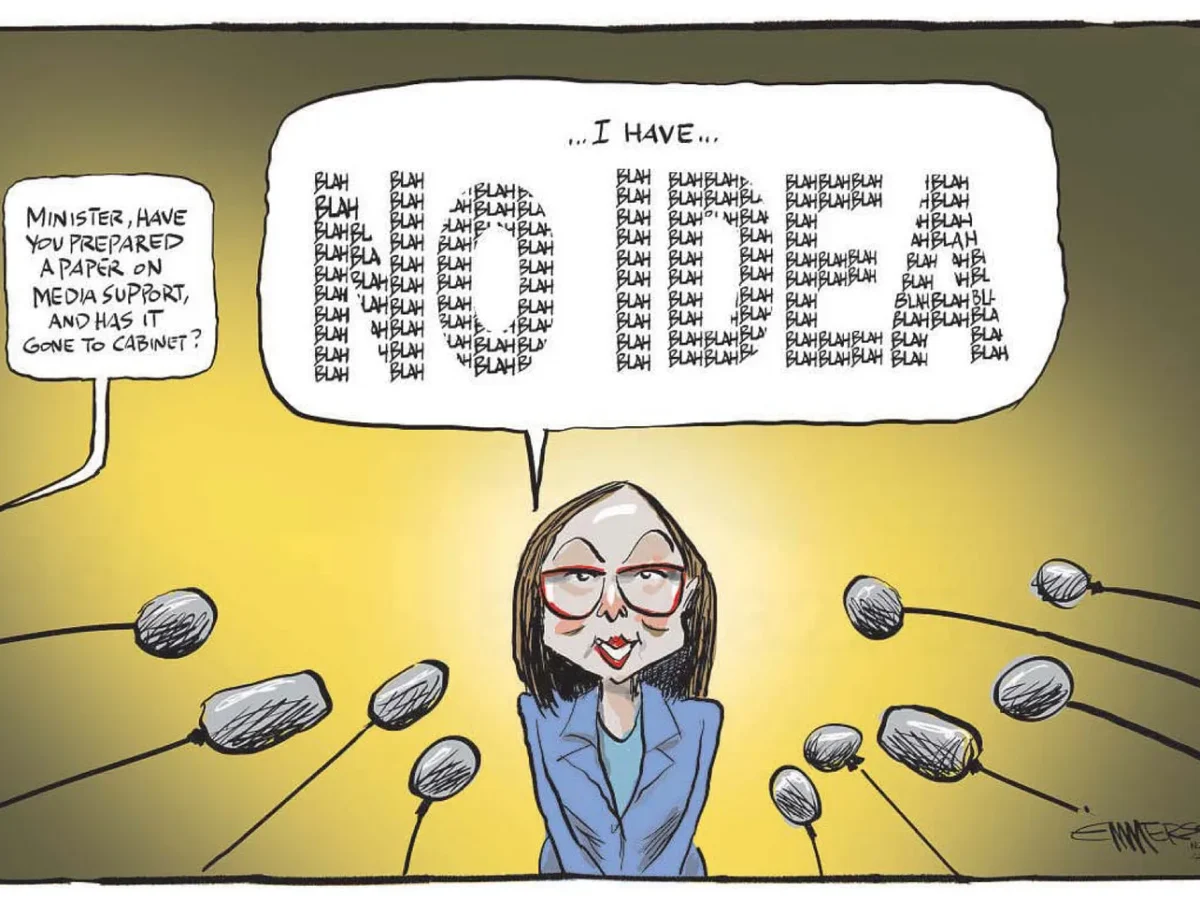

MELISSA LEE should be deprived of her ministerial warrant. Her handling – or non-handling – of the crisis engulfing the New Zealand news media has been woeful. The fate of New Zealand’s two linear television networks, a question which the Minister of Broadcasting, Communications and Digital Media could have settled long ago, remains inexcusably obscure.…

Keep readingWould Helen Clark Please Just STFU

Most Kiwis prefer their past Prime Ministers to either be dead or silent, but since Helen Clark shuffled off in ignominy in 2008 after being trounced in the election by John Key, neither she nor Key has managed to put a cork in it. Bill English thankfully has barely uttered a squeak, but don’t even…

Keep readingThe BFD General Debate

Good morning, welcome to our daily General Debate. On General debate, you are encouraged as a commenter to share your own stories, discuss other news, bring NEW news, catch up with friends or make new friends with other commenters. To participate you’ll need to sign up for a Disqus account which is free, quick, and…

Keep readingBritish MPs Banned but Iranian Mayors Are Celebrated

The United Kingdom has allowed Islam to infiltrate British history and culture. It is the European left that has facilitated the expansion of Islamism across the continent this century, what the French call ‘Islamo-overload’. Its home is in Belgium, specifically Brussels, where British ministers and other European leaders are silenced but Iranian mayors are celebrated.

Keep readingFace of the Day

When Jahden Nelson went to work on Tuesday, April 19, 2022, he had no idea the day would end with him fighting for his life in hospital.

Keep readingThe BFD Nightcap

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they…

Keep readingFriday Fur

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingPredator End Credits with Cheers Theme

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingThe Most Amazing Heavy Machinery In The World

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingConvicted but NOT Sorry

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingThe BFD Daily Roundup

Just a brief note to readers who like to add their own contributions to Daily Roundup in the comments. This post is for family-friendly humour ONLY thank you.

Keep readingToday in Rock History

Today in Rock History is a music orientated segment where we would like to encourage readers to share their thoughts and tastes in music and discuss the various…

Keep readingWhen It’s Biden He Turns a Blind Eye

The ‘whistleblower’ who sparked Donald Trump’s first impeachment was deeply involved in the political maneuverings behind Biden-family business schemes in Ukraine that Trump wanted probed, newly obtained emails…

Keep readingA Game of Defence Peas and Shells

Labor talks up strategic urgency — puts strategic spending on the never-never.

Keep reading