The BFD Nightcap

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingWednesday Weapons

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingBuilding a Large Log Cabin Alone. 4 Days in the Wild Forest.

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingYour Rights Are An ILLUSION

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep reading“Unsafe & Ineffective”

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingThe BFD Backchat

On Backchat, you are free to share your own stories, discuss other news or catch up with friends. To participate you’ll need to sign up for a Disqus account which is free, quick, and easy.

Keep readingThe BFD Daily Roundup

Just a brief note to readers who like to add their own contributions to Daily Roundup in the comments. This post is for family-friendly humour ONLY thank you.

Keep readingToday in Rock History

Today in Rock History is a music orientated segment where we would like to encourage readers to share their thoughts and tastes in music and discuss the various aspects of any music topic.

Keep readingTrump Is a Rorschach Test for the Body Politic

It is no secret that Donald Trump is a hot wire that either fires up the imagination of voters or fries the brain.

For those of us who experience Trump as a Promethean bringer of enlightening fire to the dark barren fields of modern politics, it is hard to fathom the reaction of those who…

Keep readingLabor Doing What Labor Does

Same as it ever was: Labor are lumping us with forever debt.

Keep readingThe BFD Stuff Up of the Day

Check out the latest media stuff ups both locally and around the world.

Keep readingLaughter Is the Best Medicine

This regular daily post is the place to joke and banish negative thoughts.

Keep readingJustice Delayed Is Better than Nothing

A well-deserved win for Nick Patterson — but is justice delayed, justice denied?

Keep reading‘Perfect Storm’ of Rock-Bottom Marriage & Fertility Rates

Family First NZ is warning that the declining marriage and fertility rates and high family breakdown rates are setting up a ‘perfect storm’ for negative social consequences in…

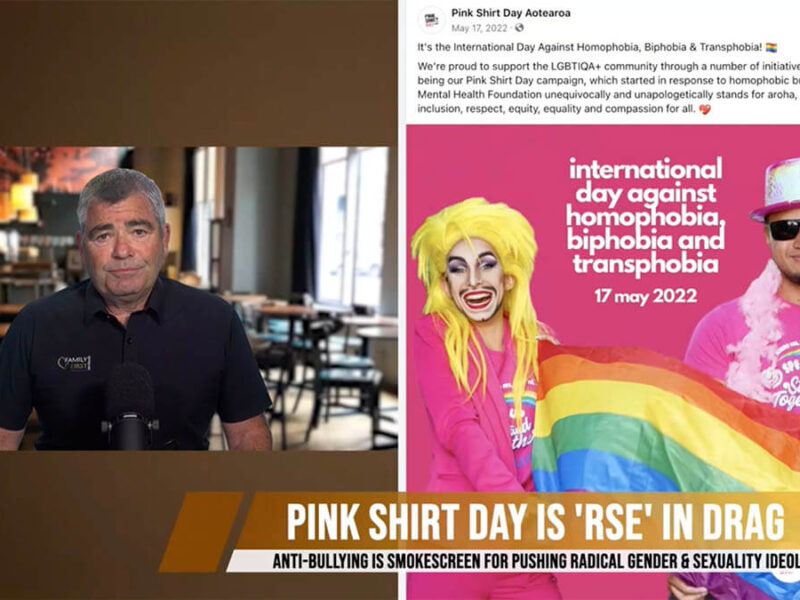

Keep readingPink Shirt Day Is RSE in Drag

Many parents are not aware that, while well-intentioned, Pink Shirt Day (coming up on May 17) is being used by activists to politicise gender theory and sexual identity…

Keep readingThis Looks Like a Job for Captain Obvious!

Despite repeated complaints from parents — and a terror attack — a Perth school refuses to shut down its Jihadi Juniors room.

Keep readingFluoridation of Our Water

Fluoridation of water, in an at best ill-advised attempt to improve dental health, not only condemns the population to significant health risks, but also represents yet another example…

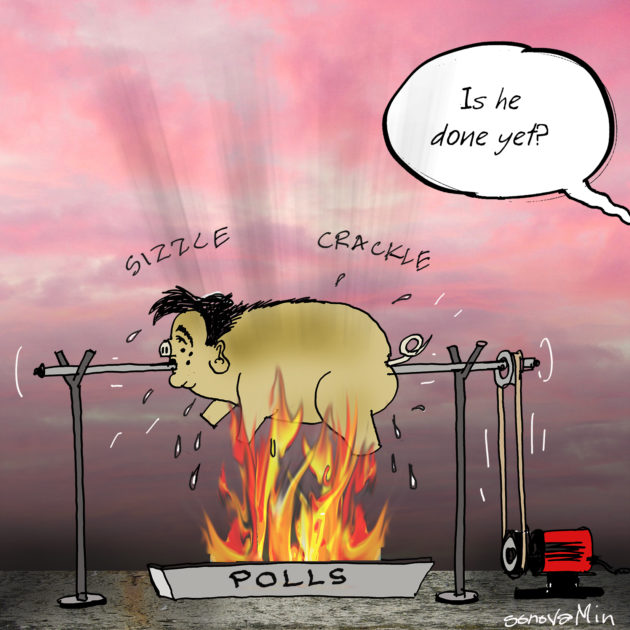

Keep readingIt Ain’t Half Hot, Nanny

I guess it’s hard to imagine working in the heat when you spend all your time in an air-conditioned office in Canberra.

Keep reading