Not the ‘Weed’ That You Grew up With

Today there are many different cannabis concentrates that have high levels of THC, typically ranging from 40% to 70%, and more than 80% in some cases, depending on the method of extraction.

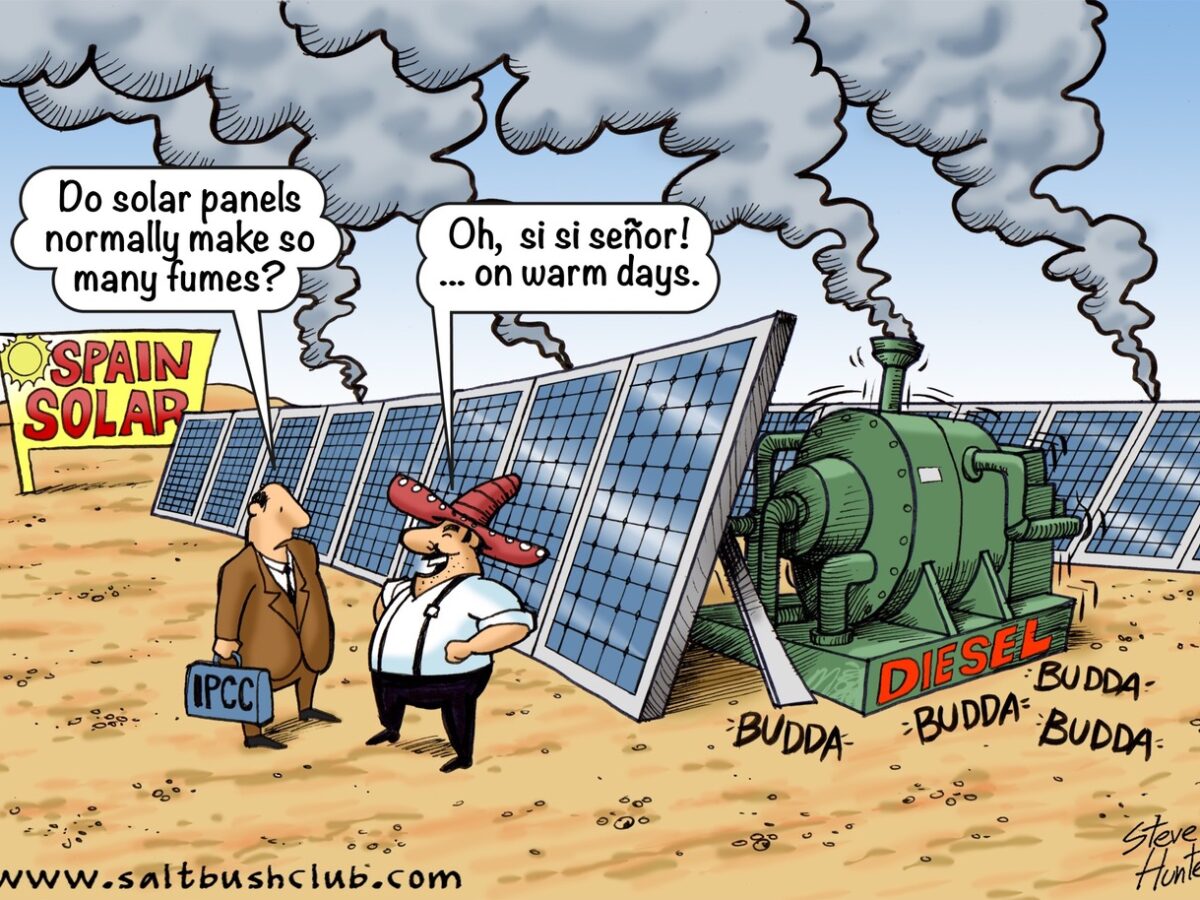

Keep readingA Diesel in the Shed

Today, after Aussies have enjoyed decades of abundant reliable cheap electricity from coal, green energy gambling has taken Australia back to that era which kept a diesel in the shed.

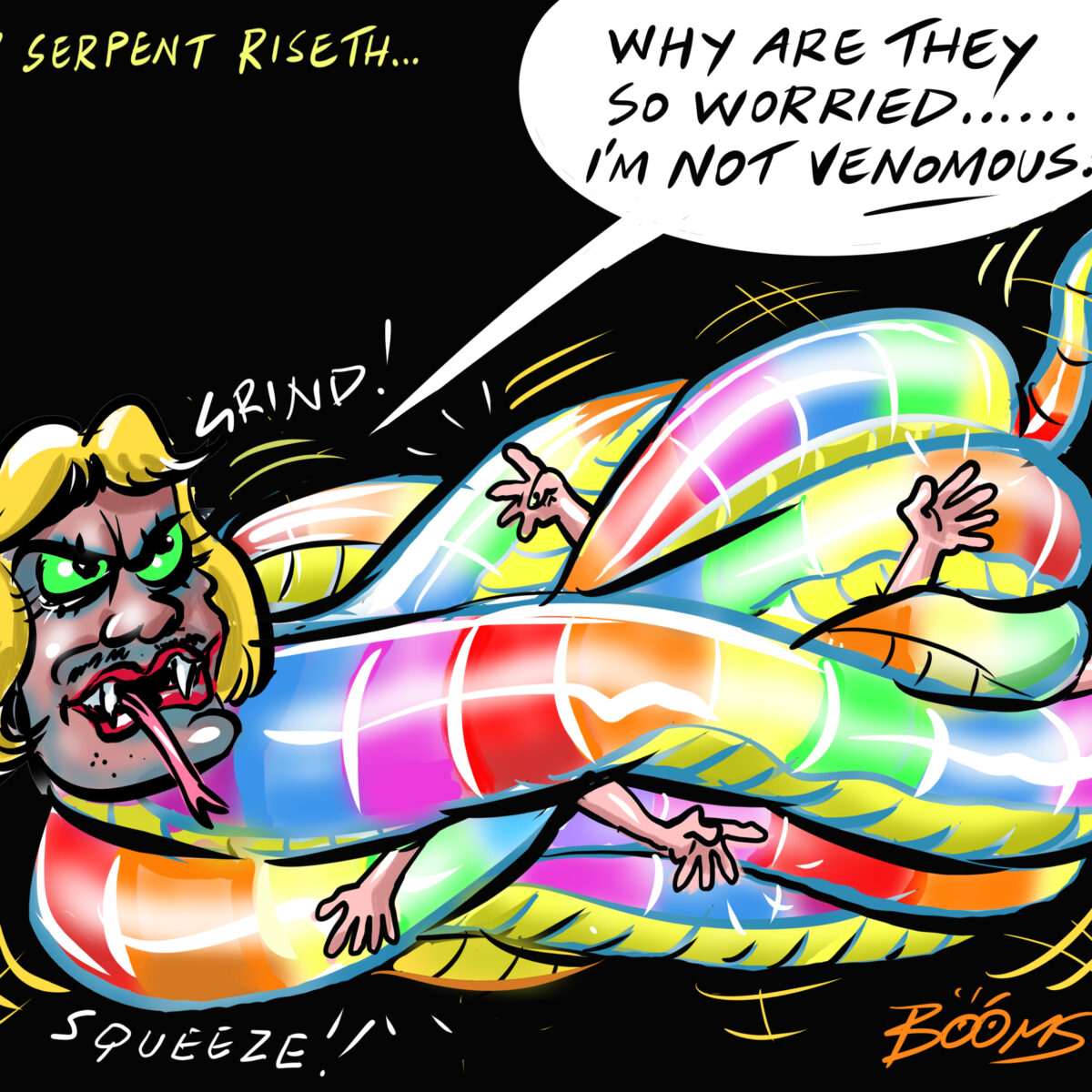

Keep readingThe Rainbow Shield of Steel

It’s “brave” to send blackmailers dick pics and then nark on your colleagues — as long as you’re gay.

Keep readingThe Foodstuffs Facial Recognition Trial

The incident of a woman misidentified by facial recognition technology at a Rotorua supermarket should have come as no surprise.

Keep readingThe BFD General Debate

Good morning, welcome to our daily General Debate. On General debate, you are encouraged as a commenter to share your own stories, discuss other news, bring NEW news, catch up with friends or make new friends with other commenters. To participate you’ll need to sign up for a Disqus account which is free, quick, and…

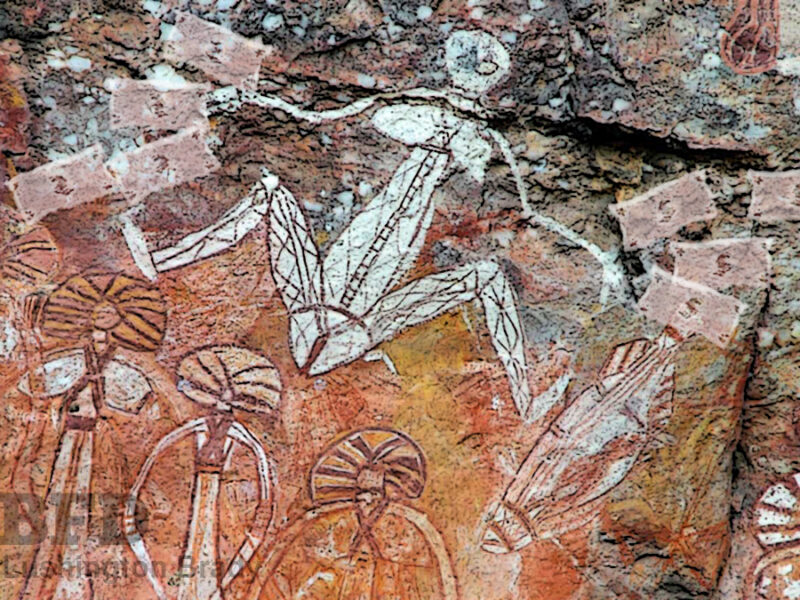

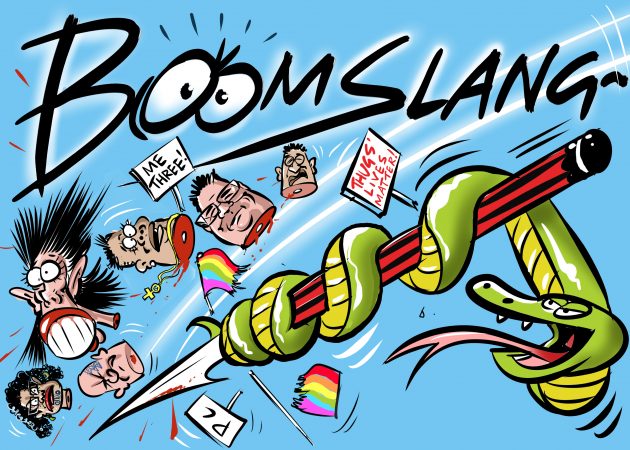

Keep readingThe Graborigine Class Have Both Hands Out

The Rainbow Serpent swims in a river of taxpayer gravy.

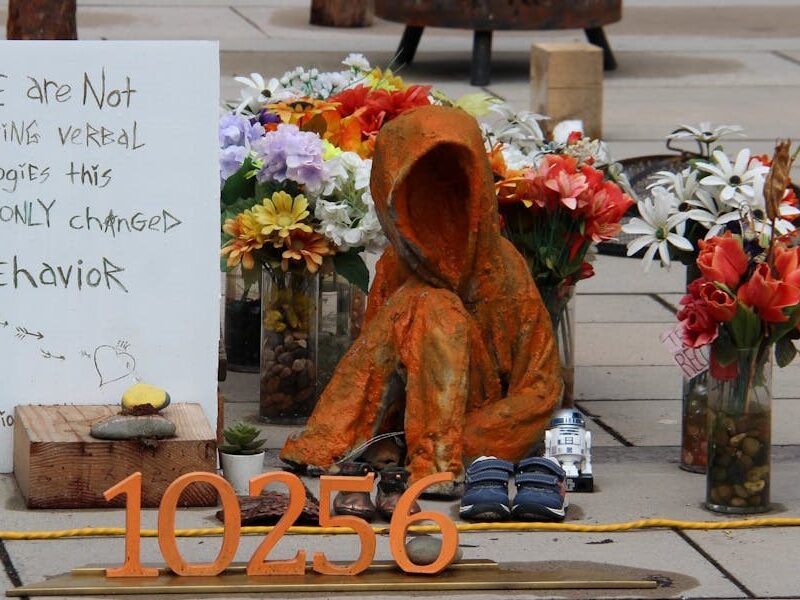

Keep reading3 Strikes Law Will Protect Families

The Three Strikes Law, will protect families from repeat violent offenders who have already been given two chances.

Keep readingThe BFD Daily Opinion Poll

Take our Daily Opinion Poll and see how your views compare to other readers and then share the poll on social media.

Keep readingWhere Will It All End?

I hope Brian Tamaki and his followers win their court cases against their local councils and their ‘rainbow’ initiatives. And I hope he wins against the…

Keep readingUrgent Changes to System Through First RMA Amendment Bill

The coalition Government is delivering on its commitment to improve resource management laws and give greater certainty to consent applicants, with a Bill to amend the Resource Management…

Keep readingThe End of the World

An article recently published on the Newsroom website cheerfully proclaimed ‘there will be a billion climate deaths in the coming century’. Just a random example of the constant…

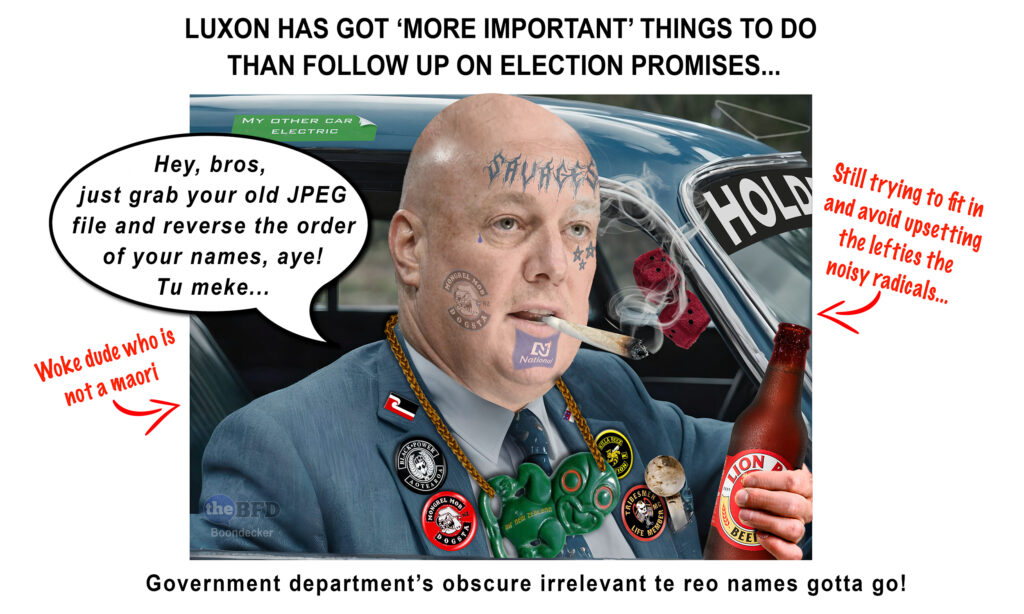

Keep readingPM Needs to Don His Hard Hat

Christopher Luxon would do well to reflect on the reasons his government was elected to office.

Keep readingAbout as Non-partisan as You Can Get

I listened to a Mediawatch bulletin from RNZ and heard the authors of the Trust in Media report exhorting news outlets to carry less opinion across their outlets,…

Keep readingLabour – The Party for Crims

While the Government moves to honour an election promise by introducing legislation to bring back the Three Strikes laws, Labour is hell bent on proving that they are…

Keep readingLetter to the Editor

Dear Editor

It is another Hipkins disaster.

Keep readingFace of the Day

One of New Zealand’s best-known and biggest home-grown consumer brands has been sold in a massive, multimillion-dollar commercial deal.

Keep reading