The BFD Nightcap

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingCyst Saturday

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingOutrageous

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingWTF is Happening?

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

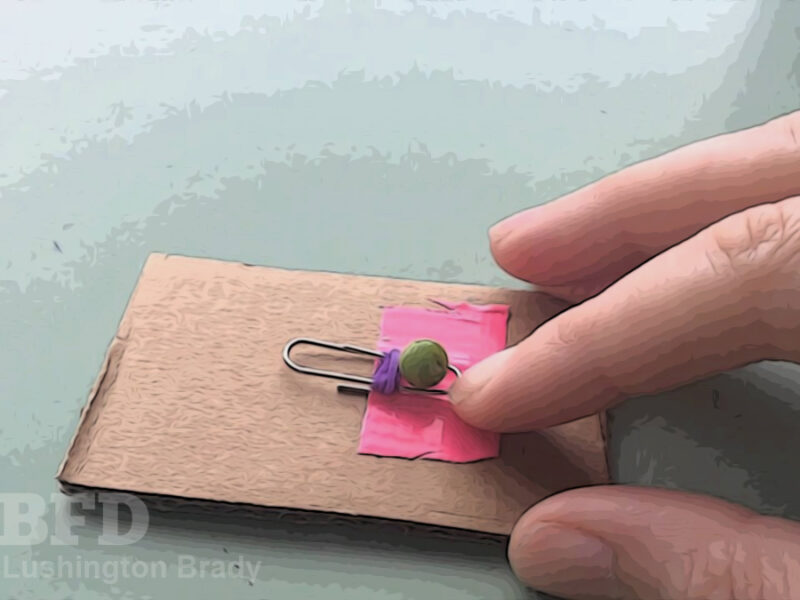

Keep readingMaking A Stone Knife From Start To Finish

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingThe BFD Backchat

On Backchat, you are free to share your own stories, discuss other news or catch up with friends. To participate you’ll need to sign up for a Disqus account which is free, quick, and easy.

Keep readingThe BFD Daily Roundup

Just a brief note to readers who like to add their own contributions to Daily Roundup in the comments. This post is for family-friendly humour ONLY thank you.

Keep readingToday in Rock History

Today in Rock History is a music orientated segment where we would like to encourage readers to share their thoughts and tastes in music and discuss the various aspects of any music topic.

Keep readingPresident Biden Must Not Encourage Illegal Mass Migration from Haiti

“It’s better to be the United States’ enemy than its friend.” Foreign officials tell me this is their perception under the Biden Administration, which has a strange habit of appeasing our adversaries while holding our allies to impossible standards. It’s bad foreign policy, plain and simple. Moreover, it’s encouraging chaos in our region.

Keep readingIs Diversity Really Our Strength?

Claims of the benefits of DEI fall apart under critical examination.

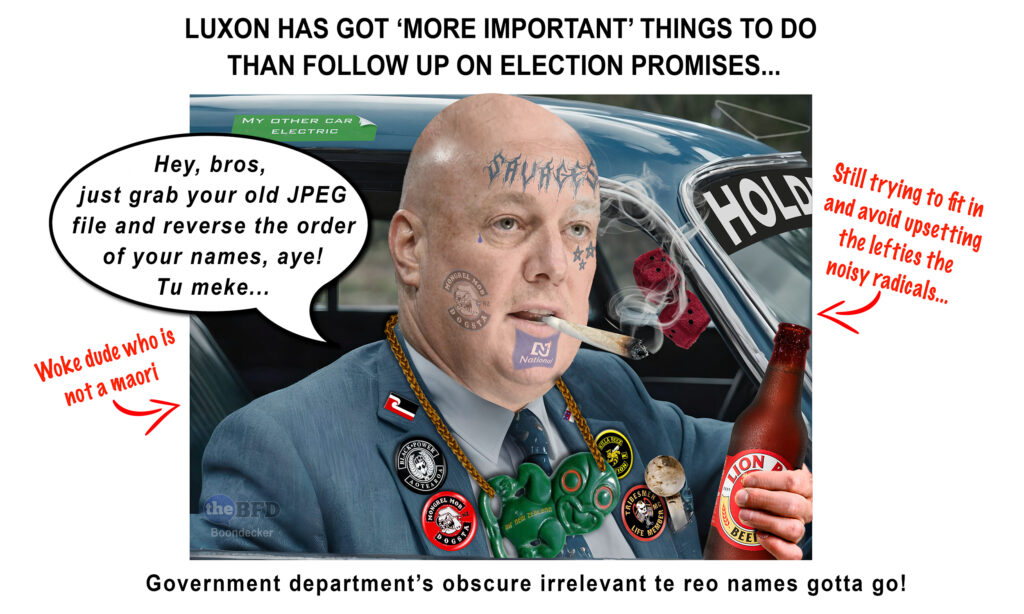

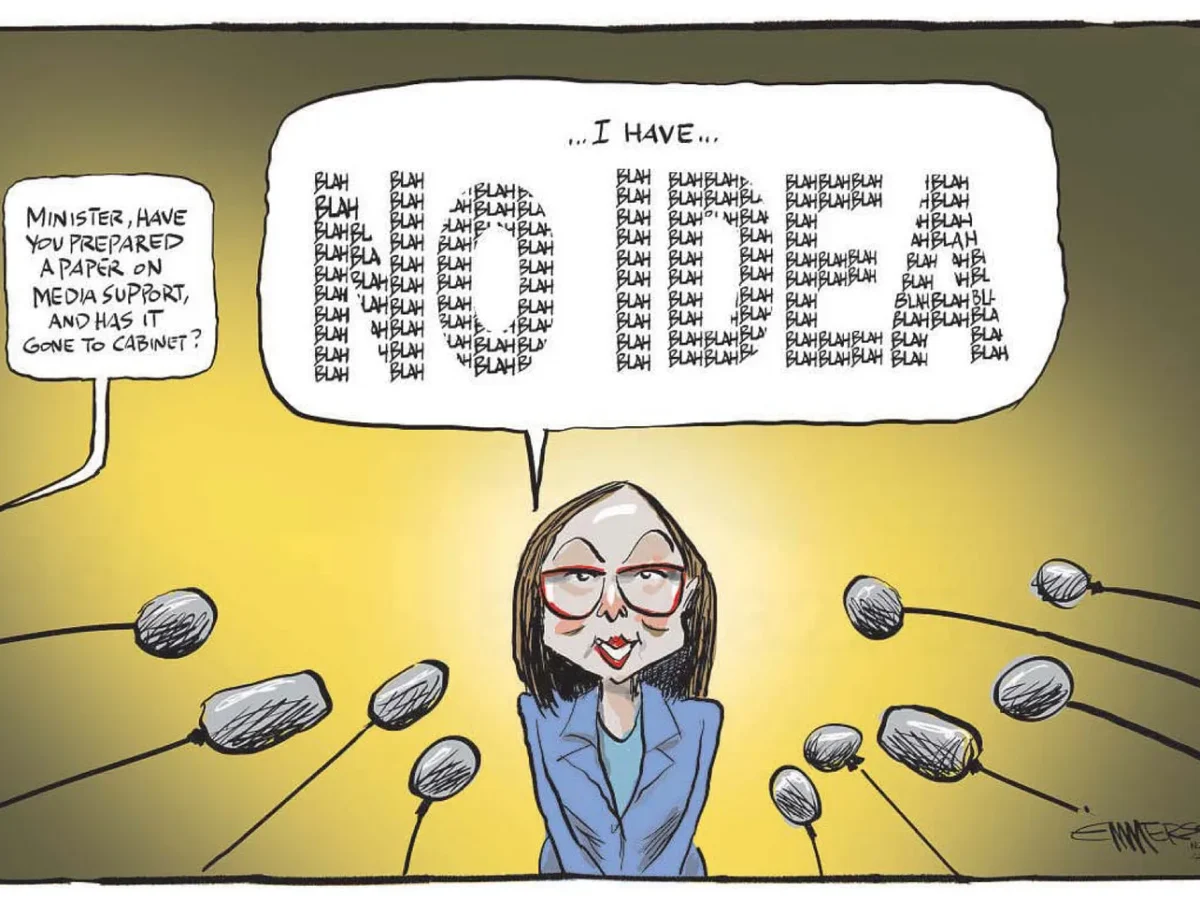

Keep readingThe BFD Stuff Up of the Day

Check out the latest media stuff ups both locally and around the world.

Keep readingLaughter Is the Best Medicine

This regular daily post is the place to joke and banish negative thoughts.

Keep readingA Modest Proposal to Solve Wokeism

If you want to stop the creep of wokeism in politics, the answer is obvious.

Keep readingThe Polish Midwife Who Delivered 3000 Babies at Auschwitz

Fifty years ago died one of the most remarkable women of the 20th century. You have probably never heard of Stanistawa Leszczynska. Few people have. Yet she was…

Keep readingThe Importance of Hope

I am a great believer in hope. In fact, I think of myself as a rather hopeful person. Despite a world that often feels like it has gone…

Keep readingWhat Iran Didn’t Win

The response of some Gulf states to Iran’s attack is ominous for its plans for regional hegemony.

Keep readingWhy AI Chatbots Have a Free Speech Problem

Google recently made headlines globally because its chatbot Gemini generated images of people of color instead of white people in historical settings that featured white people. Adobe Firefly’s…

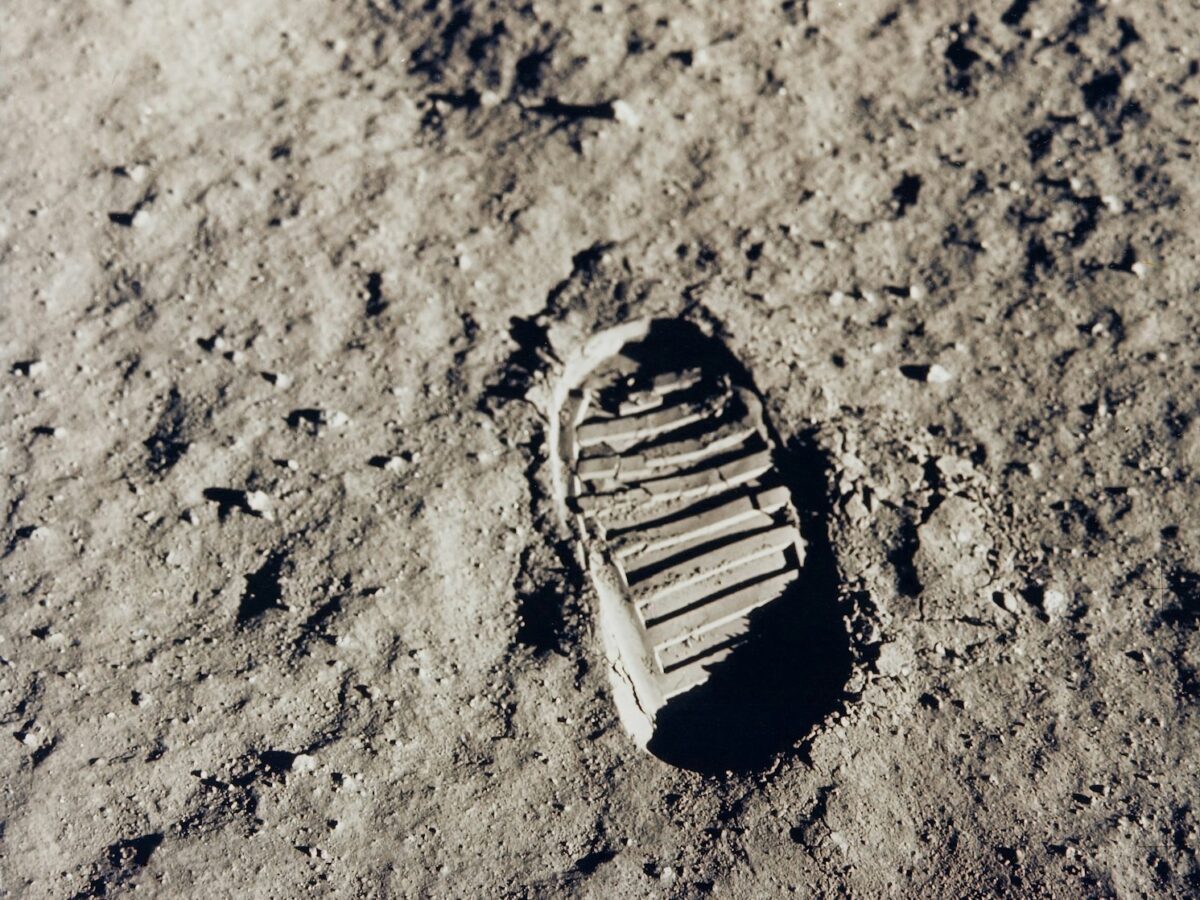

Keep readingJapan Is Going to the Moon

The new Moon race is just as political as the last one.

Keep reading