Taniwha

You do NOT want to miss out on this cartoon!

Sign up today for a Bronze level membership to enjoy BoomSlang and SonovaMin’s cartoons.

Keep readingTribalism Is Not the Answer

Tribalism requires an ‘enemy’, and won’t rest until it finds or invents one.

Keep readingThe BFD Daily Opinion Poll

Take our Daily Opinion Poll and see how your views compare to other readers and then share the poll on social media.

Keep readingA Well Kept Secret

Our future as a strong, financially independent nation in a political world skewed by outside political forces’ interests depends on the coalition government holding it together long enough to correct the injustices of the previous government. Clearly, there’s some fairly large hurdles for Luxon to get over if he is to go the distance.

Keep readingThe Narrative Was Not What They Intended

There’s been a lot of discussion about the UK’s CASS review which nailed the final nail in the coffin of sending our vulnerable children down the path of believing they can change their sex. But the NZ media were all keen to push back on the research with a local anecdotal story – and they…

Keep readingThe BFD General Debate

Good morning, welcome to our daily General Debate. On General debate, you are encouraged as a commenter to share your own stories, discuss other news, bring NEW news, catch up with friends or make new friends with other commenters. To participate you’ll need to sign up for a Disqus account which is free, quick, and…

Keep readingThe Ban on Gang Patches Only Looks Good on the Surface

Despite the threats to liberty and the impracticality of the legislation highlighted by the Police Association, Police Minister Mark Mitchell remains adamant that the patch ban will become law.

Keep readingTheir Low Standards

Los Angeles prior to WW2 was a bit of a joke; it was isolated, and difficult to get to; it had Hollywood but not much else.

Keep readingJacinda’s Legacy Is a Sick Joke

The latest abortion statistics make grim and upsetting reading, with a 25% increase in abortions since the decriminalisation of abortion in March 2020 – four years ago. The focus on Maori being able to abort their babies – even late-term – is equally sickening.

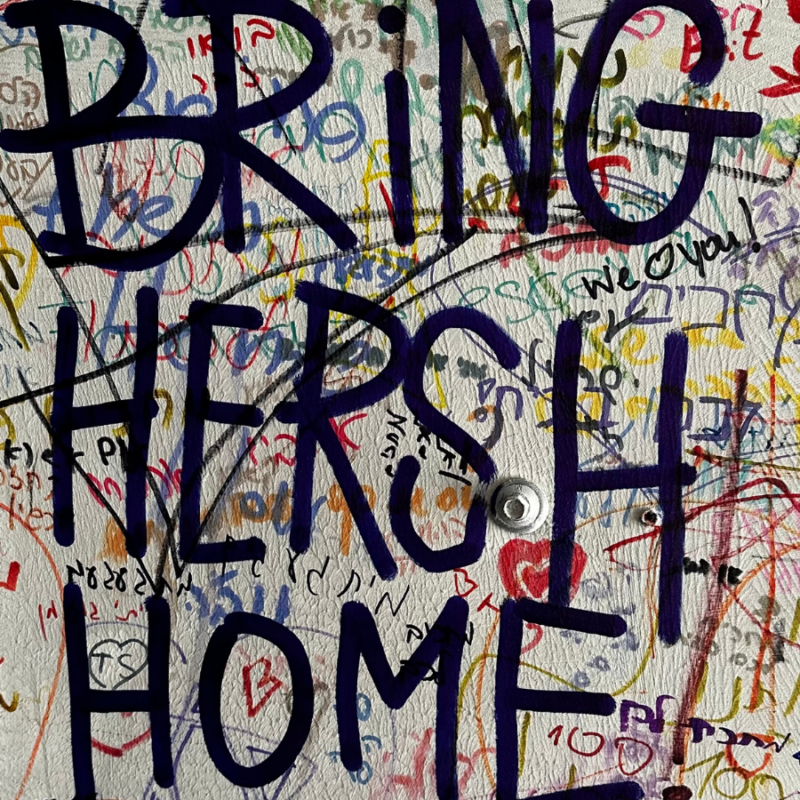

Keep readingHamas Releases Hostage Video

Hamas has released a new video of American-Israeli Hersh Goldberg-Polin, held hostage in the Gaza Strip since October 7th.

Keep readingHapless Hypocrite Hipkins Hysterical

Chris Hipkins has the worst job in politics, Opposition Leader. But he has made the worst job even more unbearable with his often hysterical hyperbole as…

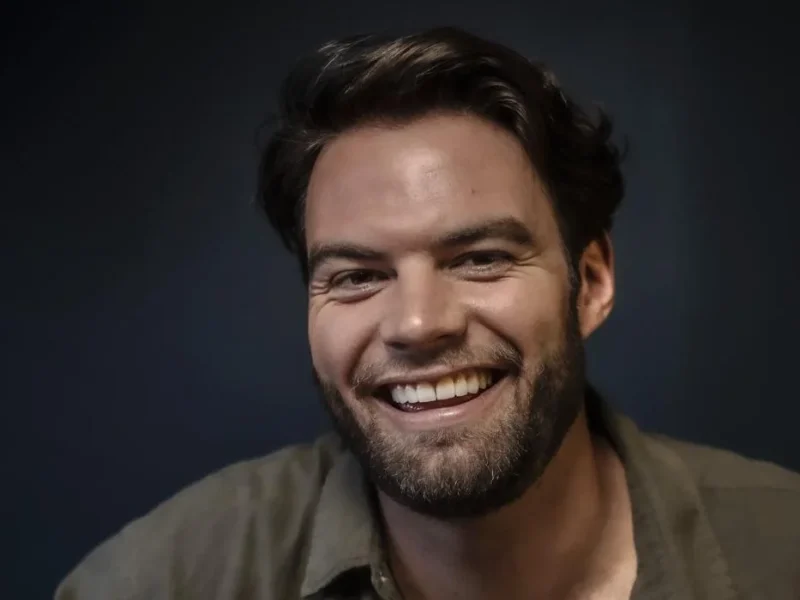

Keep readingFace of the Day

Ryan Bridge is first in line to be the new host of Newstalk ZB’s 5-6am Early Edition morning show, Stuff understands.

Keep readingThe BFD Daily Proverb

Interfering in someone else’s argument is as foolish as yanking a dog’s ears.

Keep readingThe BFD Nightcap

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingTiny Home Thursday

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingThis Is Why We Don’t Toss Out Broken Microwaves

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingBohemian Catsody – A Rhapsody Parody Song for Every Cat Queen and King!

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingIsrael-Hamas War: Israeli Ambassador on Rising Civilian Deaths in Gaza

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep reading