The BFD Stuff Up of the Day

Check out the latest media stuff ups both locally and around the world.

Keep readingLaughter Is the Best Medicine

This regular daily post is the place to joke and banish negative thoughts.

Keep readingHow Did We Come To This?

When our elites hate Australia, why wouldn’t those who think we’re all “infidels”, anyway?

Keep readingIsrael’s Water Innovation Benefits the World

Israeli commitments to inspiration, innovation, and especially perspiration continue to pay dividends. They’ve fostered new technologies and techniques that turn dry wastelands into bountiful farmlands, using desalination, water recycling, drip irrigation, and constant refinements.

Keep readingPfizer’s Tricks

In November 2020 a Pfizer employee posted the following tweet, which was retweeted by a number of senior Pfizer employees, including the Medical Director of Pfizer UK, Dr Berkeley Phillips.

Keep readingThe BFD General Debate

Good morning, welcome to our daily General Debate. On General debate, you are encouraged as a commenter to share your own stories, discuss other news, bring NEW news, catch up with friends or make new friends with other commenters. To participate you’ll need to sign up for a Disqus account which is free, quick, and…

Keep readingHow’d the Last Lefty Love Affair with Islam Work Out?

The left refuse to learn from history, not least what happens when they get in bed with the mad mullahs.

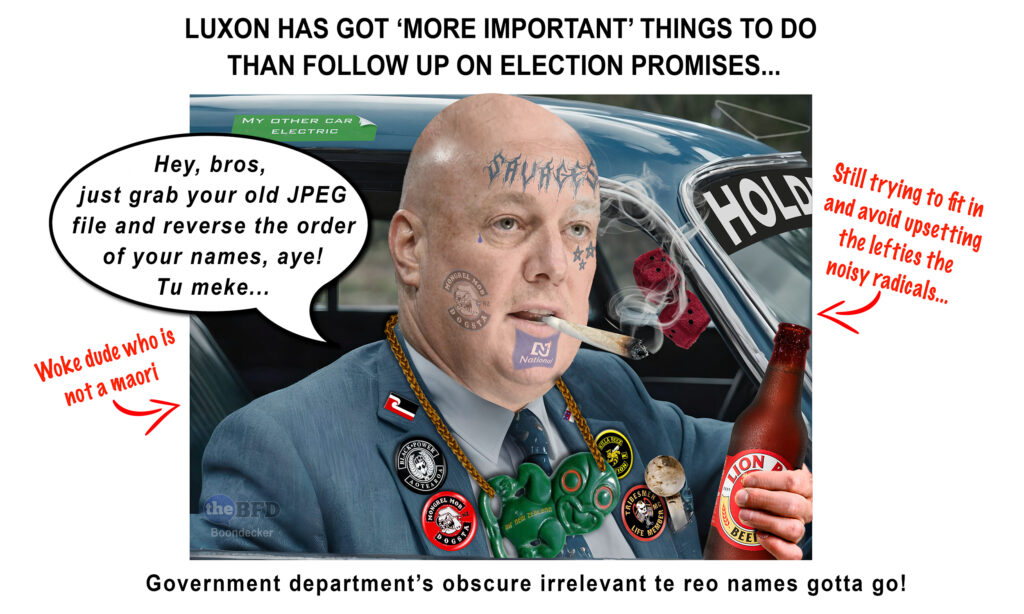

Keep readingRacist Advertising

Over the last six months it’s become fashionable for our advertising agencies to use Maoris in their television advertisements.

Keep readingThe BFD Comment of the Week

As part of our drive to keep our comment section the best in New Zealand we showcase each week an example of a top notch comment that adds value to The BFD.

Keep reading‘EVS Are a Bit Shite’, #35

Like 3D movies and Laserdiscs, EVs are a rapidly fading fad.

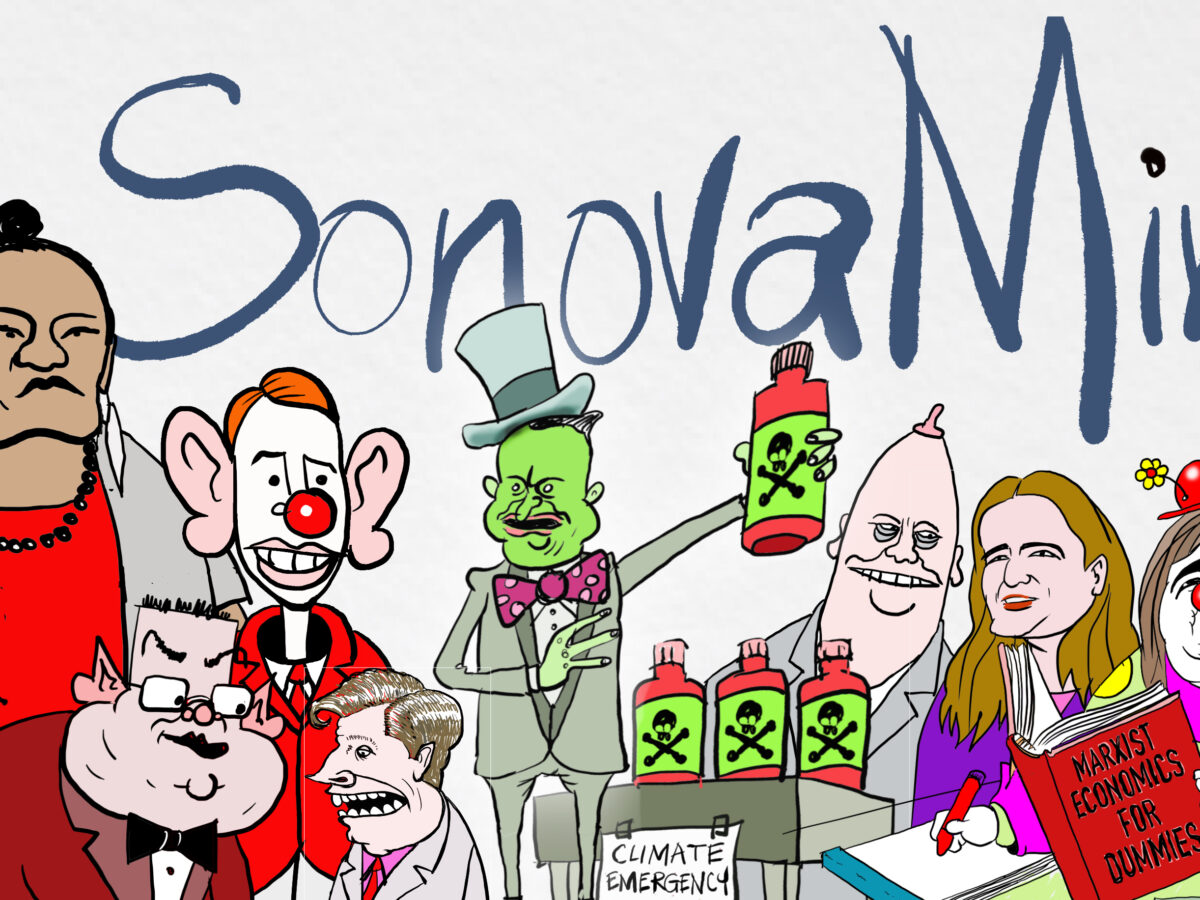

Keep readingCompulsory Viewing

You do NOT want to miss out on this cartoon!

Sign up today for a Bronze level membership to enjoy BoomSlang and SonovaMin’s cartoons.

Keep readingBabies and Benefits – No Good News

Every year around one in five new-born babies will be reliant on their caregivers benefit by Christmas. This pattern has persisted from at least 1993. For Maori the…

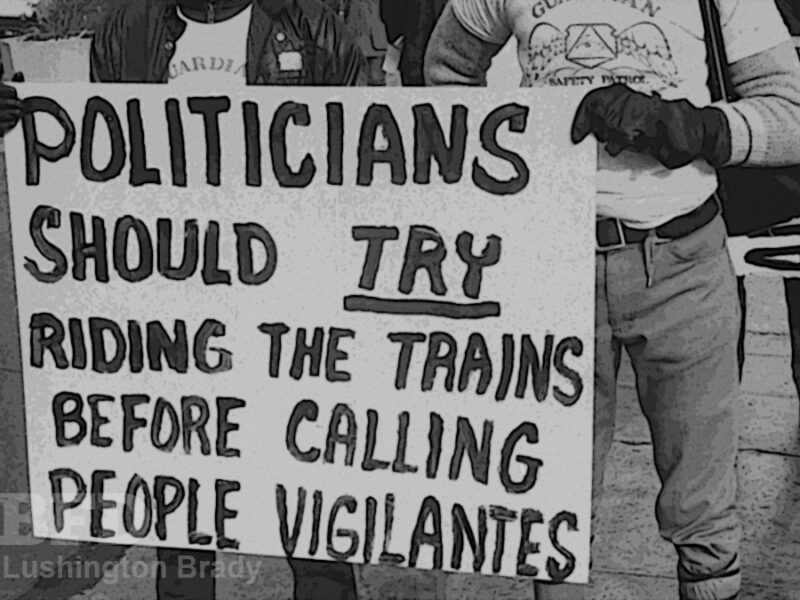

Keep reading‘People Are Scared of Each Other’

What a mess. Australia was warned what would happen, did it anyway, and are now paying an enormous price for “cultural diversity” – a price which rises far…

Keep readingWhere Is the Integrity From the Top Twelve?

While it is hard for people to lose positions many of the new roles since 2017 have done little or nothing to help the children of New Zealand…

Keep readingWhat’s the Point of Melissa Lee?

While Stuff steps in to take over the delivery of a nightly news bulletin on TV3, Broadcasting Minister Melissa Lee flails on the sidelines with plans to re-regulate…

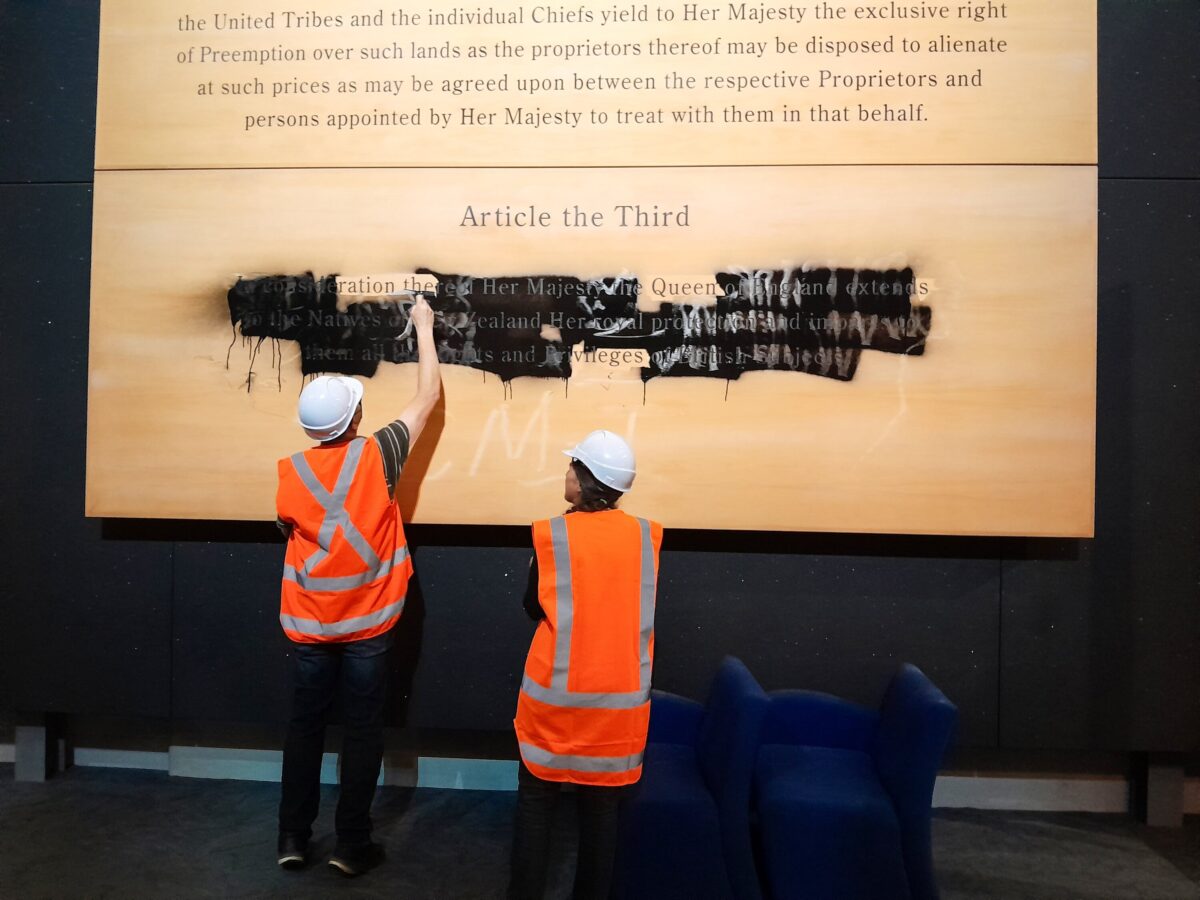

Keep readingThe Treaty and Maori Wards

Pagani pins her argument for Maori wards or ‘power-sharing’ on the Treaty of Waitangi, but there is nothing in the Treaty (any version or translation) that speaks of…

Keep readingWhy Not AUKUS?

Singapore’s foreign policy provides a model worthy of study. Singapore appears to have a cordial relationship with both the US and China.

Keep readingWhy? Because They Don’t Add Any Value

The media luvvies are all exercised about the pending job losses in the state sector. It’s a shame that they weren’t similarly exercised about job losses in the…

Keep reading