The BFD Nightcap

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingTaste Tuesday

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingEsafety Commissioner Says That She Wants to “Minimise the Amount of Content Australians Can See”

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingPro-Vaxxer Left Speechless as Dr. McCullough Drops the Disturbing Truth About the COVID Shots

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingAre We Enslaved to One Side of the Brain?

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingThe BFD Backchat

On Backchat, you are free to share your own stories, discuss other news or catch up with friends. To participate you’ll need to sign up for a Disqus account which is free, quick, and easy.

Keep readingThe BFD Daily Roundup

Just a brief note to readers who like to add their own contributions to Daily Roundup in the comments. This post is for family-friendly humour ONLY thank you.

Keep readingToday in Rock History

Today in Rock History is a music orientated segment where we would like to encourage readers to share their thoughts and tastes in music and discuss the various aspects of any music topic.

Keep readingJohn Cleese on Cancel Culture

John Cleese is the master of both silly walks and sublime comedy takes.

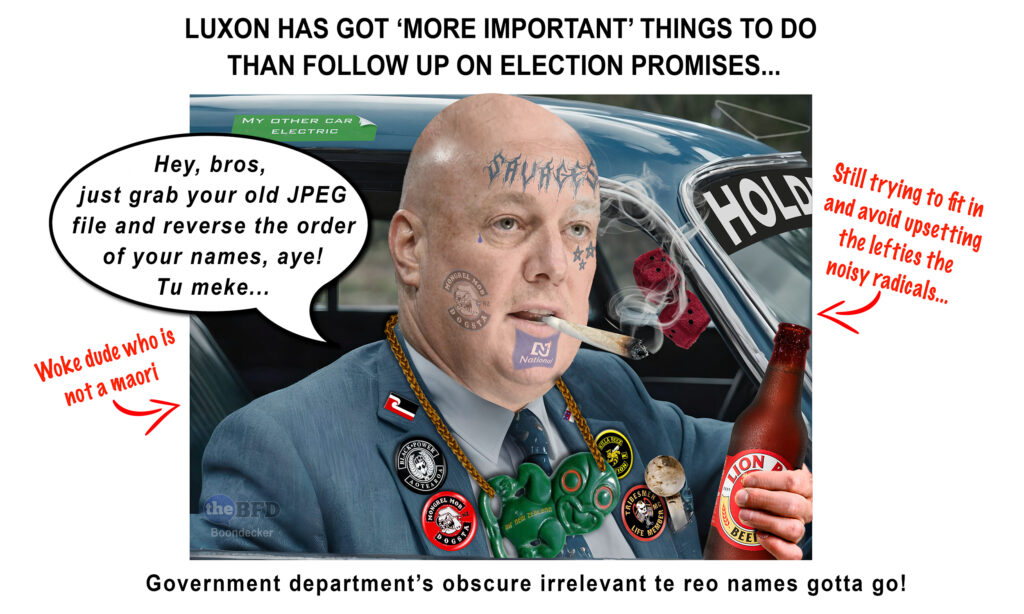

Keep readingMaths without Taking Your Shoes Off

“Indigenous Maths” and “Indigenous Science” are oxymorons — but not as moronic as many academics.

Keep readingThe BFD Stuff Up of the Day

Check out the latest media stuff ups both locally and around the world.

Keep readingLaughter Is the Best Medicine

This regular daily post is the place to joke and banish negative thoughts.

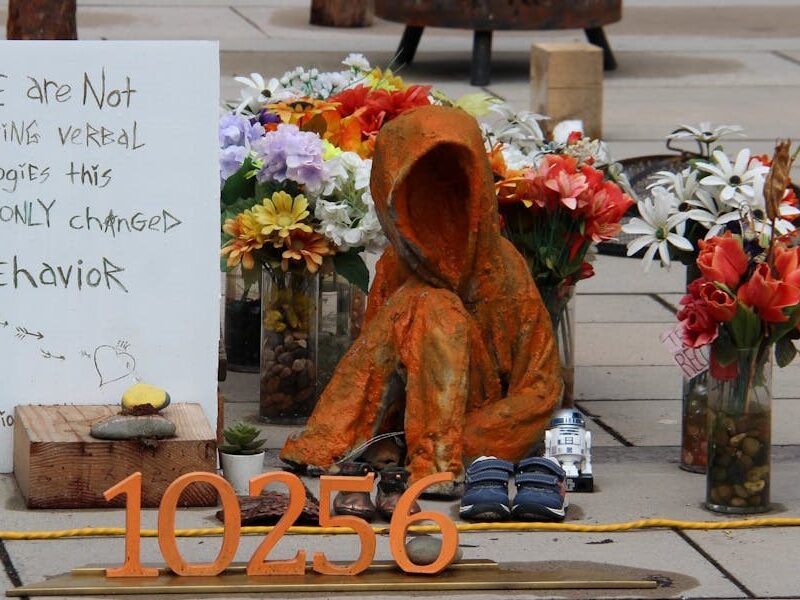

Keep readingWell, Doesn’t That Just Ooze Sincerity?

After years of excoriating her former boss, suddenly Brittany Higgins is all grovelling apologies.

Keep readingGreens Against Reliable, Safe, and Clean Technologies

Despite its commitment to “no more gas, oil, or coal,” Friends of the Earth has launched a campaign against one of the nation’s “greenest” governors, California’s Gavin Newsom.

Keep readingReporters Hostile to Trump Not Happy With Push Back

Charlotte Klein at Vanity Fair was upset that the Trump campaign is “cutting off access” to reporters who are extremely hostile to Trump, including Brian Stelter (also of Vanity Fair) and Washington Post reporter…

Keep readingSome Genocides Are More Equal Than Others

Thirty years after the tragic 1994 mass killings in Rwanda, when mobs of ethnic majority Hutus slaughtered between 500,000 and 800,000 ethnic minority Tutsis with machetes, the idea of genocide is…

Keep readingThree Ministers Will Have Absolute Power

Many commentators are drawing parallels between the new Fast Track legislation and the National Development Act 1979, which then Prime Minister Robert Muldoon used to push through the…

Keep readingNZ’s New Rules Won’t Help Low-Skilled Migrant Workers

The New Zealand government claims its recently announced changes to visa rules will address exploitation and unsustainable migration. In reality, the new rules are likely to have the…

Keep reading