ANZAC Day: Gallipoli

In 2015 Dad and I were at the dawn ceremony at ANZAC Cove and then the service at Chunuk Bair.

Keep readingANZAC Day: Lest we forget

This is my ANZAC Day tribute posting. ANZAC Day means a great deal for me and my family. I suppose it is because we have a connection to the original ANZACS in 1915 and Gallipoli, and to a veteran of a war much fresher in our minds, Vietnam.

Keep readingANZAC Day: The Band Played ‘Waltzing Matilda’

The Pogues-The band played Waltzing Matilda

Keep readingFace of the Day

Chief Petty Officer Tapene, from Hikurangi, north of Whangarei, enlisted in 2001. He specialised in communications and has since deployed throughout Asia, Hawaii, the Gulf of Arabia and Australia.

Keep readingThe BFD General Debate

Good morning, welcome to our daily General Debate. On General debate, you are encouraged as a commenter to share your own stories, discuss other news, bring NEW news, catch up with friends or make new friends with other commenters. To participate you’ll need to sign up for a Disqus account which is free, quick, and…

Keep readingThe BFD Daily Proverb

If the godly give in to the wicked, it’s like polluting a fountain or muddying a spring.

Keep readingThe BFD Nightcap

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingWednesday Weapons

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingWhat Actually Happens When You Overfill Your Motor Oil?

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they…

Keep readingThis Bulldozer Changes Everything Israel’s Insane D9 Caterpillar!

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they…

Keep reading50 Miles On An Inflatable Raft Through The Desert

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingThe BFD Daily Roundup

Just a brief note to readers who like to add their own contributions to Daily Roundup in the comments. This post is for family-friendly humour ONLY thank you.

Keep readingToday in Rock History

Today in Rock History is a music orientated segment where we would like to encourage readers to share their thoughts and tastes in music and discuss the various…

Keep readingThe Intifada Comes to America. Now What?

“Death to America!” We are used to that chant. Maybe too used to it.

If you are old enough, you heard it in 1979 during the Iranian hostage…

Keep readingWaleed Dodges and Bullshits Again

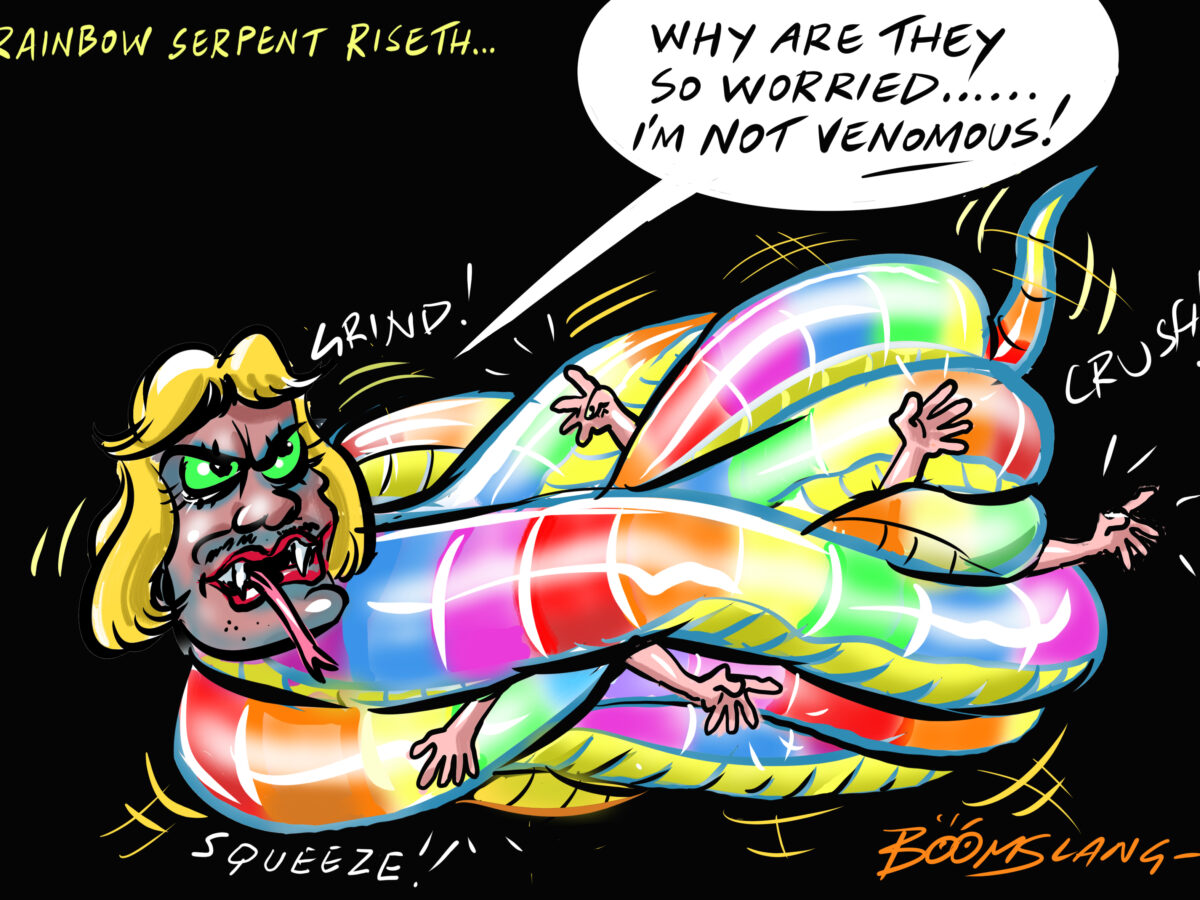

Waleed Aly tries his best to baffle with prolix bullshit, but his agenda is all-too-clear.

Keep readingThe BFD Stuff Up of the Day

Check out the latest media stuff ups both locally and around the world.

Keep readingLaughter Is the Best Medicine

This regular daily post is the place to joke and banish negative thoughts.

Keep readingBrown Shirts on Campus

“Pro-Palestine” students are demanding shows of hands in class — photographing dissenters.

Keep reading