The BFD Nightcap

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingWednesday Weapons

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingWhat Actually Happens When You Overfill Your Motor Oil?

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingThis Bulldozer Changes Everything Israel’s Insane D9 Caterpillar!

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep reading50 Miles On An Inflatable Raft Through The Desert

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingThe BFD Backchat

On Backchat, you are free to share your own stories, discuss other news or catch up with friends. To participate you’ll need to sign up for a Disqus account which is free, quick, and easy.

Keep readingThe BFD Daily Roundup

Just a brief note to readers who like to add their own contributions to Daily Roundup in the comments. This post is for family-friendly humour ONLY thank you.

Keep readingToday in Rock History

Today in Rock History is a music orientated segment where we would like to encourage readers to share their thoughts and tastes in music and discuss the various aspects of any music topic.

Keep readingThe Intifada Comes to America. Now What?

“Death to America!” We are used to that chant. Maybe too used to it.

If you are old enough, you heard it in 1979 during the Iranian hostage crisis when supporters of Ayatollah Khomeini invaded the U.S. Embassy in Tehran.

Keep readingWaleed Dodges and Bullshits Again

Waleed Aly tries his best to baffle with prolix bullshit, but his agenda is all-too-clear.

Keep readingThe BFD Stuff Up of the Day

Check out the latest media stuff ups both locally and around the world.

Keep readingLaughter Is the Best Medicine

This regular daily post is the place to joke and banish negative thoughts.

Keep readingBrown Shirts on Campus

“Pro-Palestine” students are demanding shows of hands in class — photographing dissenters.

Keep readingNot the ‘Weed’ That You Grew up With

Today there are many different cannabis concentrates that have high levels of THC, typically ranging from 40% to 70%, and more than 80% in some cases, depending on…

Keep readingA Diesel in the Shed

Today, after Aussies have enjoyed decades of abundant reliable cheap electricity from coal, green energy gambling has taken Australia back to that era which kept a diesel in…

Keep readingThe Rainbow Shield of Steel

It’s “brave” to send blackmailers dick pics and then nark on your colleagues — as long as you’re gay.

Keep readingThe Foodstuffs Facial Recognition Trial

The incident of a woman misidentified by facial recognition technology at a Rotorua supermarket should have come as no surprise.

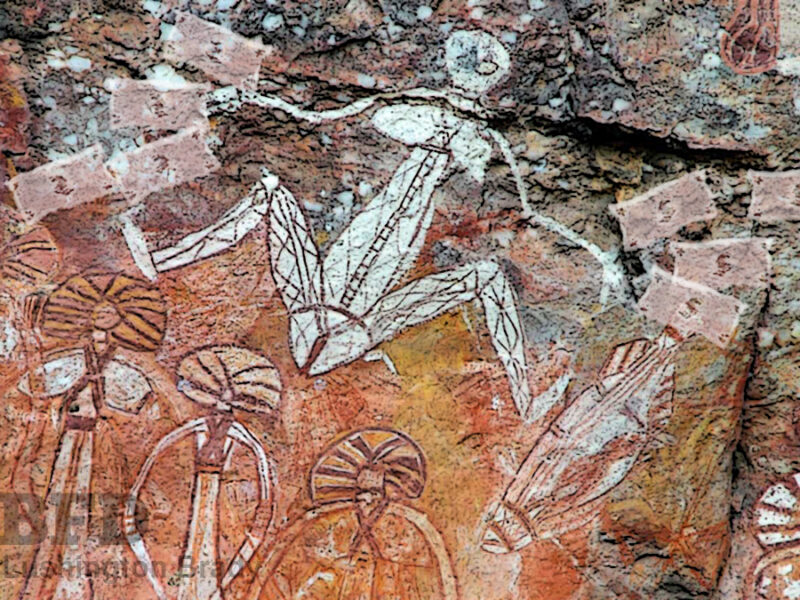

Keep readingThe Graborigine Class Have Both Hands Out

The Rainbow Serpent swims in a river of taxpayer gravy.

Keep reading