‘EVS Are a Bit Shite’, #35

Like 3D movies and Laserdiscs, EVs are a rapidly fading fad.

Keep readingCompulsory Viewing

You do NOT want to miss out on this cartoon!

Sign up today for a Bronze level membership to enjoy BoomSlang and SonovaMin’s cartoons.

Keep readingBabies and Benefits – No Good News

Every year around one in five new-born babies will be reliant on their caregivers benefit by Christmas. This pattern has persisted from at least 1993. For Maori the number jumps to over one in three.

Keep reading‘People Are Scared of Each Other’

What a mess. Australia was warned what would happen, did it anyway, and are now paying an enormous price for “cultural diversity” – a price which rises far more exponentially than food prices at Woolies.

Keep readingWhere Is the Integrity From the Top Twelve?

While it is hard for people to lose positions many of the new roles since 2017 have done little or nothing to help the children of New Zealand get a better education. In fact – the attendance and success of those students – have moved inversely to the willy-nilly employment strategies of Iona Holsted and…

Keep readingThe BFD General Debate

Good morning, welcome to our daily General Debate. On General debate, you are encouraged as a commenter to share your own stories, discuss other news, bring NEW news, catch up with friends or make new friends with other commenters. To participate you’ll need to sign up for a Disqus account which is free, quick, and…

Keep readingWhat’s the Point of Melissa Lee?

While Stuff steps in to take over the delivery of a nightly news bulletin on TV3, Broadcasting Minister Melissa Lee flails on the sidelines with plans to re-regulate the broadcasting sector.

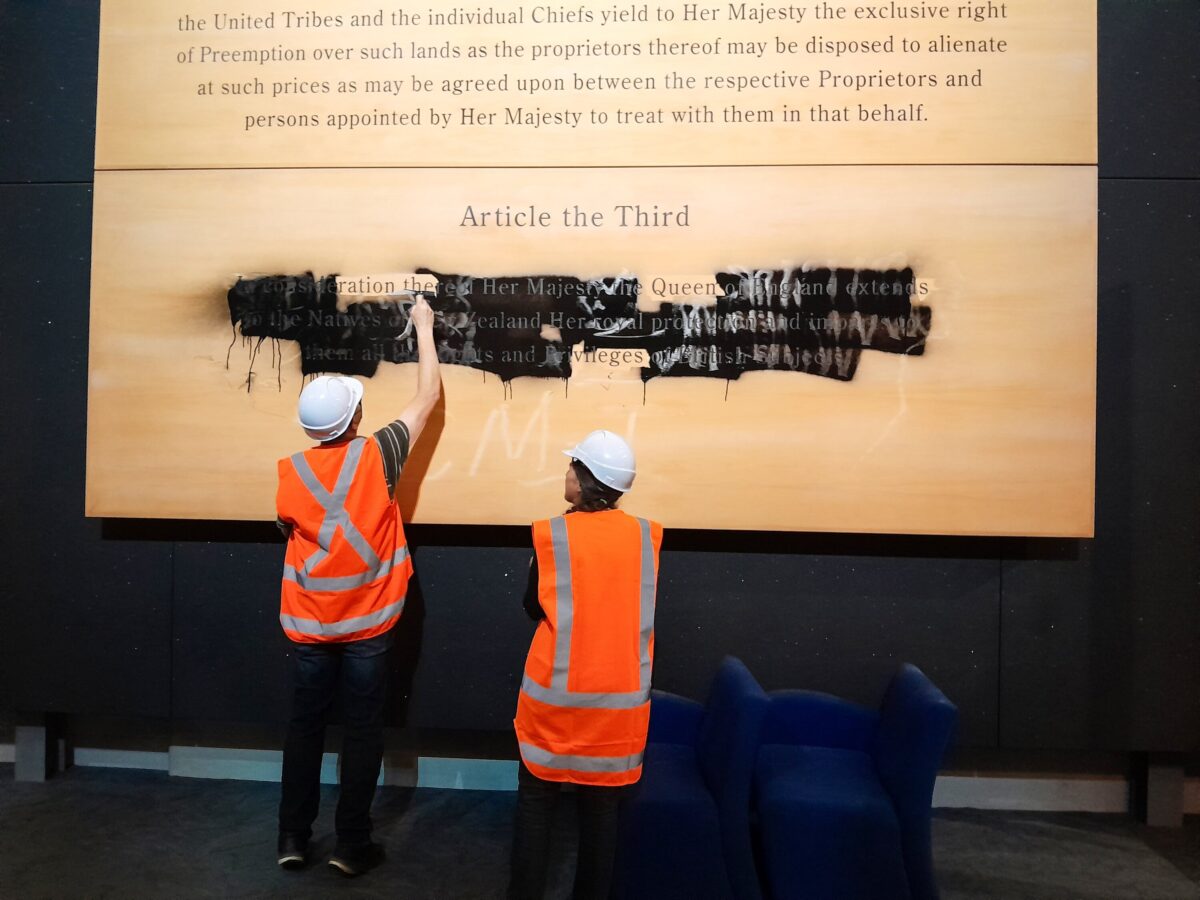

Keep readingThe Treaty and Maori Wards

Pagani pins her argument for Maori wards or ‘power-sharing’ on the Treaty of Waitangi, but there is nothing in the Treaty (any version or translation) that speaks of separate racial representation in governing bodies.

Keep readingWhy Not AUKUS?

Singapore’s foreign policy provides a model worthy of study. Singapore appears to have a cordial relationship with both the US and China.

Keep readingWhy? Because They Don’t Add Any Value

The media luvvies are all exercised about the pending job losses in the state sector. It’s a shame that they weren’t similarly exercised about job losses…

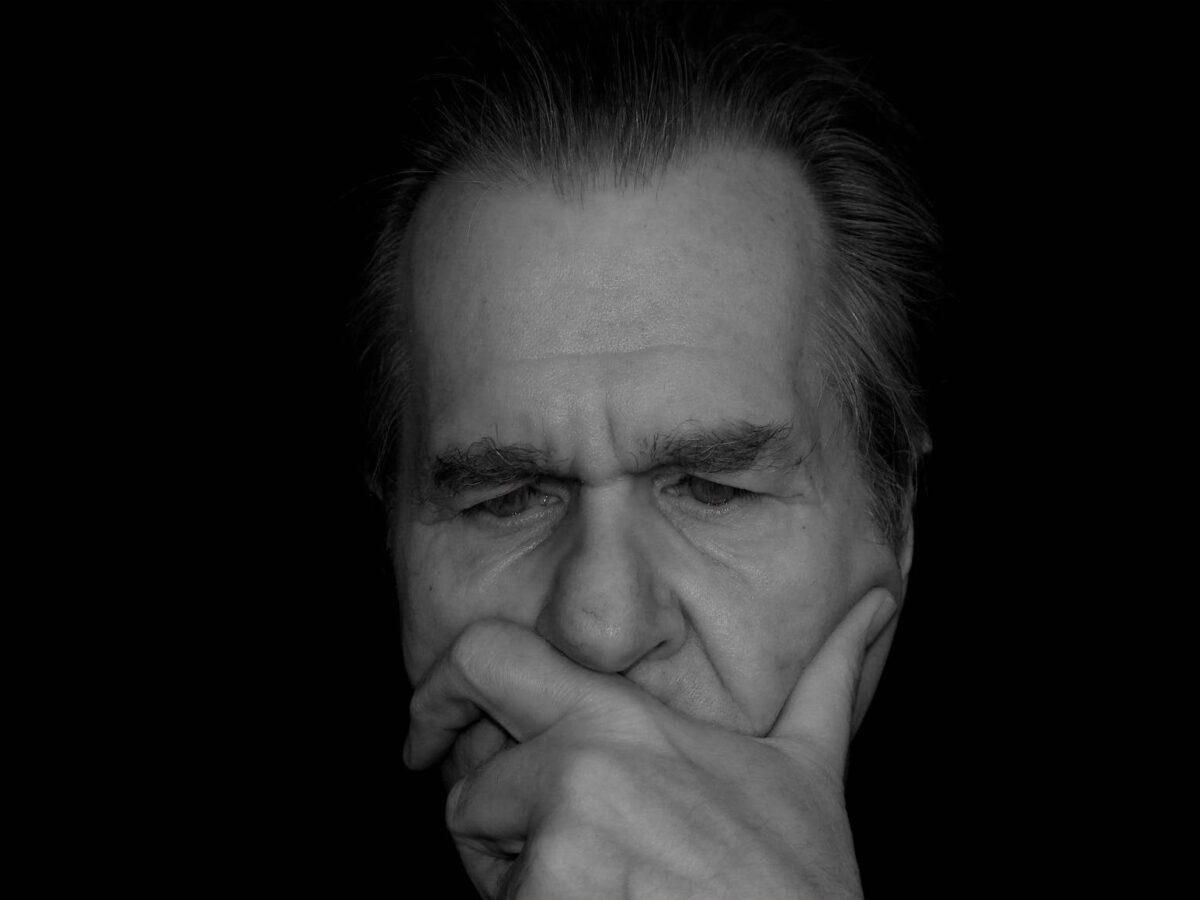

Keep readingFace of the Day

Sir Colin Giltrap, the philanthropist and businessman who founded the influential and powerful Giltrap Group about 60 years ago, died last night aged 84.

Keep readingThe BFD Daily Proverb

Discipline your children while there is hope. Otherwise you will ruin their lives.

Keep readingThe BFD Nightcap

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingWhy Israeli Namer Armored Vehicle Strikes Fear into Hamas

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingTransform Yourself into a Monster | Jordan Peterson

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingNZ Dad Says ‘Hate Crime’ Was an Act of Love

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have…

Keep readingThe BFD Daily Roundup

Just a brief note to readers who like to add their own contributions to Daily Roundup in the comments. This post is for family-friendly humour ONLY thank you.

Keep readingToday in Rock History

Today in Rock History is a music orientated segment where we would like to encourage readers to share their thoughts and tastes in music and discuss the various…

Keep reading