The Most Amazing Heavy Machinery In The World

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingConvicted but NOT Sorry

Enjoy a BFD curated video this evening. We search the internet for the best new media news and entertainment videos for our readers so that they don’t have to.

Keep readingThe BFD Daily Roundup

Just a brief note to readers who like to add their own contributions to Daily Roundup in the comments. This post is for family-friendly humour ONLY thank you.

Keep readingToday in Rock History

Today in Rock History is a music orientated segment where we would like to encourage readers to share their thoughts and tastes in music and discuss the various aspects of any music topic.

Keep readingWhen It’s Biden He Turns a Blind Eye

The ‘whistleblower’ who sparked Donald Trump’s first impeachment was deeply involved in the political maneuverings behind Biden-family business schemes in Ukraine that Trump wanted probed, newly obtained emails from former Vice President Joe Biden’s office reveal.

Keep readingThe BFD Backchat

On Backchat, you are free to share your own stories, discuss other news or catch up with friends. To participate you’ll need to sign up for a Disqus account which is free, quick, and easy.

Keep readingA Game of Defence Peas and Shells

Labor talks up strategic urgency — puts strategic spending on the never-never.

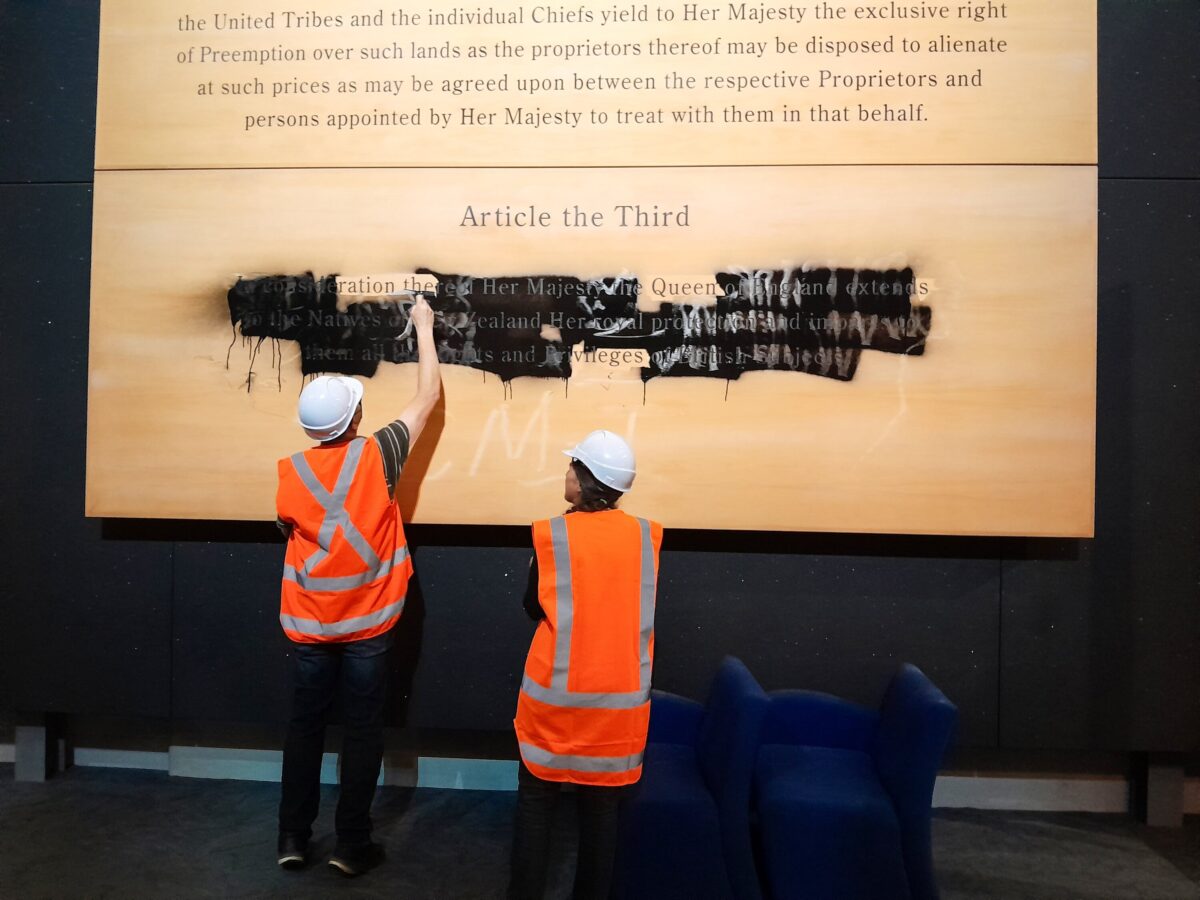

Keep readingThe BFD Stuff Up of the Day

Check out the latest media stuff ups both locally and around the world.

Keep readingLaughter Is the Best Medicine

This regular daily post is the place to joke and banish negative thoughts.

Keep readingHow Did We Come To This?

When our elites hate Australia, why wouldn’t those who think we’re all “infidels”, anyway?

Keep readingIsrael’s Water Innovation Benefits the World

Israeli commitments to inspiration, innovation, and especially perspiration continue to pay dividends. They’ve fostered new technologies and techniques that turn dry wastelands into bountiful farmlands, using…

Keep readingPfizer’s Tricks

In November 2020 a Pfizer employee posted the following tweet, which was retweeted by a number of senior Pfizer employees, including the Medical Director of Pfizer UK, Dr…

Keep readingHow’d the Last Lefty Love Affair with Islam Work Out?

The left refuse to learn from history, not least what happens when they get in bed with the mad mullahs.

Keep readingRacist Advertising

Over the last six months it’s become fashionable for our advertising agencies to use Maoris in their television advertisements.

Keep readingThe BFD Comment of the Week

As part of our drive to keep our comment section the best in New Zealand we showcase each week an example of a top notch comment that adds…

Keep reading‘EVS Are a Bit Shite’, #35

Like 3D movies and Laserdiscs, EVs are a rapidly fading fad.

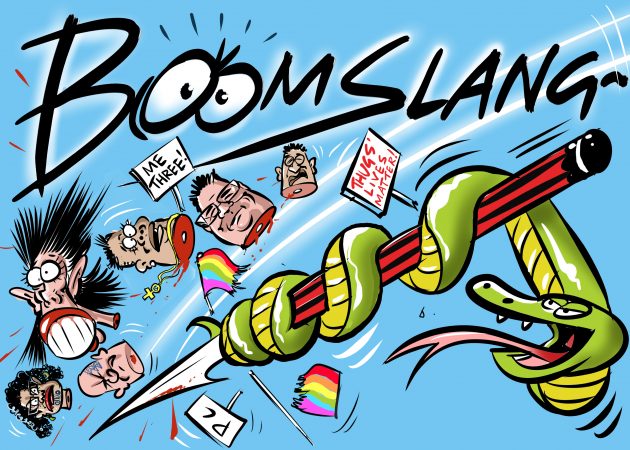

Keep readingCompulsory Viewing

You do NOT want to miss out on this cartoon!

Sign up today for a Bronze level membership to enjoy BoomSlang and SonovaMin’s cartoons.

Keep readingBabies and Benefits – No Good News

Every year around one in five new-born babies will be reliant on their caregivers benefit by Christmas. This pattern has persisted from at least 1993. For Maori the…

Keep reading