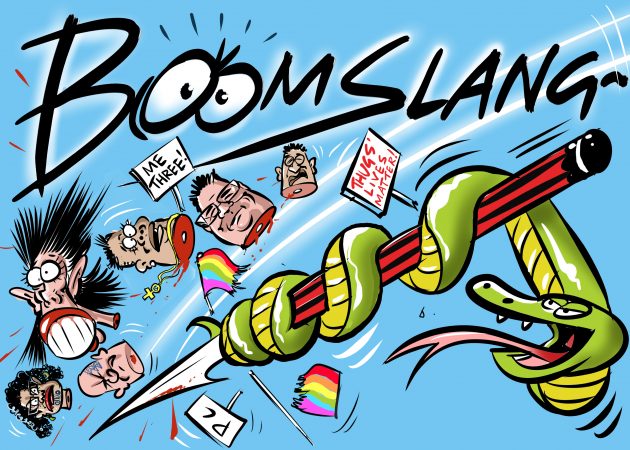

Laughter Is the Best Medicine

This regular daily post is the place to joke and banish negative thoughts.

Keep readingJustice Delayed Is Better than Nothing

A well-deserved win for Nick Patterson — but is justice delayed, justice denied?

Keep reading‘Perfect Storm’ of Rock-Bottom Marriage & Fertility Rates

Family First NZ is warning that the declining marriage and fertility rates and high family breakdown rates are setting up a ‘perfect storm’ for negative social consequences in New Zealand.

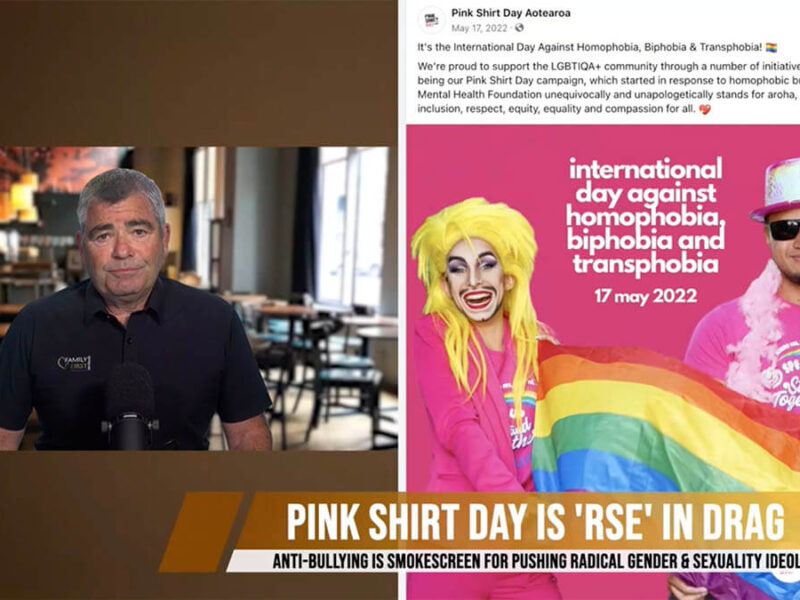

Keep readingPink Shirt Day Is RSE in Drag

Many parents are not aware that, while well-intentioned, Pink Shirt Day (coming up on May 17) is being used by activists to politicise gender theory and sexual identity of school children under the guise of anti-bullying programmes, rather than deal appropriately with the issue of school bullying which we’re all concerned about. Pink Shirt Days…

Keep readingThis Looks Like a Job for Captain Obvious!

Despite repeated complaints from parents — and a terror attack — a Perth school refuses to shut down its Jihadi Juniors room.

Keep readingThe BFD General Debate

Good morning, welcome to our daily General Debate. On General debate, you are encouraged as a commenter to share your own stories, discuss other news, bring NEW news, catch up with friends or make new friends with other commenters. To participate you’ll need to sign up for a Disqus account which is free, quick, and…

Keep readingFluoridation of Our Water

Fluoridation of water, in an at best ill-advised attempt to improve dental health, not only condemns the population to significant health risks, but also represents yet another example of forced mass medication and the trampling of individuals’ fundamental right to informed consent.

Keep readingIt Ain’t Half Hot, Nanny

I guess it’s hard to imagine working in the heat when you spend all your time in an air-conditioned office in Canberra.

Keep readingGreens Relieved Julie Anne Genter at Least Hasn’t Been Done for Shoplifting

With the recent parliament outburst of Greens MP Julie Anne Genter, and subsequent accounts of her bullying a florist about car parks, it’s fair to say…

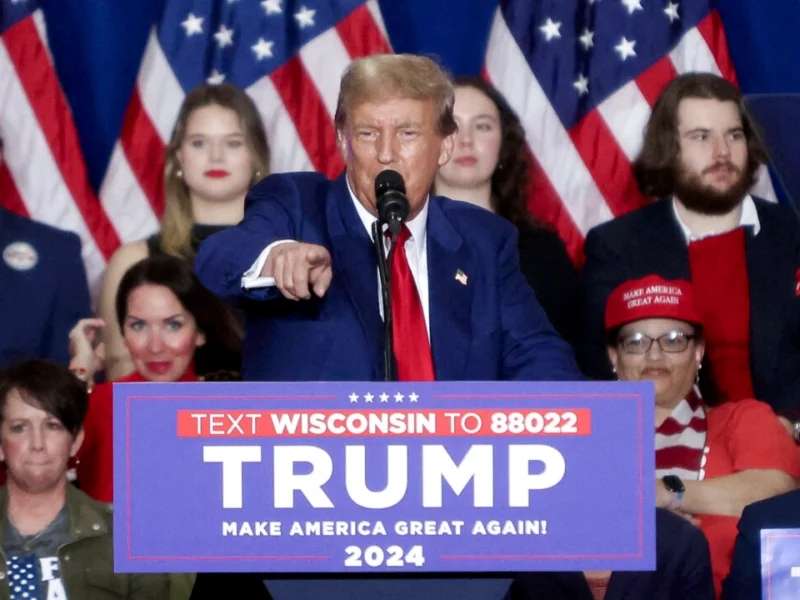

Keep readingThe BFD Daily Opinion Poll

Take our Daily Opinion Poll and see how your views compare to other readers and then share the poll on social media.

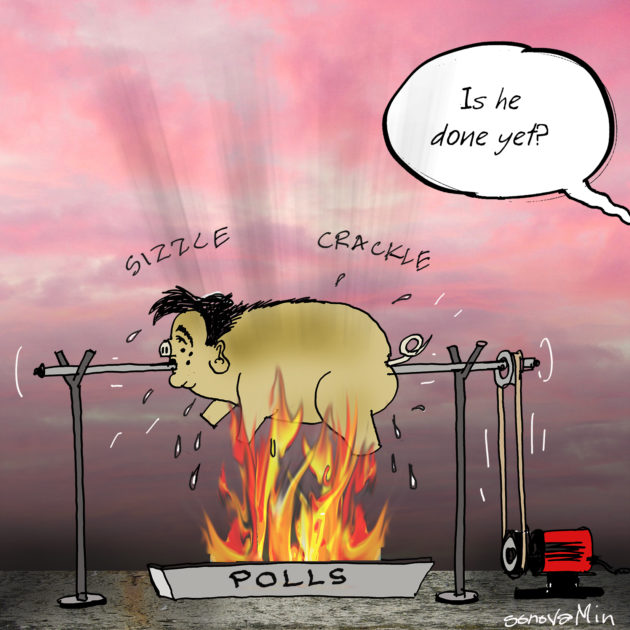

Keep readingSometimes You Have to Face Reality

Bridges had two and a bit years as opposition leader. He was opposing our weakest possible opponent; a silly girl with an IQ of 2 and a half…

Keep readingThe Labour Govt Gaslit the NZ Public

The Labour Government deliberately gaslighted the NZ public and hid vital information they received from Five Eyes about the pandemic.

Keep readingMaiki Goes for Flair Over Facts

In an article which took about a third of a page in column inches Maiki was able to highlight, unintentionally no doubt, everything that is wrong with journalism…

Keep readingAnother Green MP in Trouble

So, another week and another Green MP is in trouble. This time Julie-Anne Genter, who broke the rules of Parliament when aggressively crossing the aisle and physically fronting…

Keep readingOff to the Privileges Committee We Go

Speaker Gerry Brownlee has referred the behaviour of Julie Anne Genter to the powerful Privileges Committee, even as the Green Party says her behaviour won’t cost her any…

Keep readingMarsden Point Oil Refinery Will Remain Closed

An independent initiative to reopen the Marsden Point oil refinery has been voted down by the refinery company’s shareholders.

Keep readingSuspect of the Day

A man sought by police was captured on CCTV footage talking on a cellphone and walking in a relaxed fashion in the immediate aftermath of the shooting on…

Keep reading