Magic Rock Off-Limits to Whitey

More and more, non-Aboriginal Australians are finding themselves locked out of popular tourist spots.

Keep readingThe BFD Stuff Up of the Day

Check out the latest media stuff ups both locally and around the world.

Keep readingLaughter Is the Best Medicine

This regular daily post is the place to joke and banish negative thoughts.

Keep readingWhat Don’t They Want Us to See?

Anthony Albanese is desperate that Australians not see what is going on.

Keep readingFive Things We Discovered When We Made 16th Century Beer

It’s true that our 16th-century ancestors drank much more than Irish people do today. But why they did so and what their beer was like are questions shrouded in myth. The authors were part of a team who set out to find some answers.

Keep readingThe BFD General Debate

Good morning, welcome to our daily General Debate. On General debate, you are encouraged as a commenter to share your own stories, discuss other news, bring NEW news, catch up with friends or make new friends with other commenters. To participate you’ll need to sign up for a Disqus account which is free, quick, and…

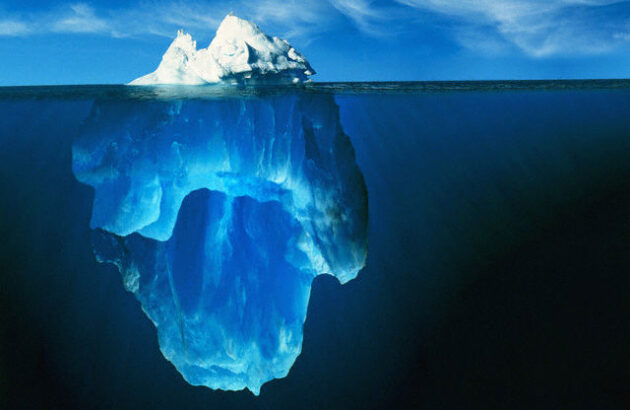

Keep readingA Digital Dark Age

They were wrong on lockdowns. They were wrong on border closures. They were wrong on school closures. They were wrong on masking. They were wrong about vaccines.

Keep readingThey Were from the Govt and They Wanted to Help

The NDIS is the single most disastrous proof of Ronald Reagan’s adage about government and help.

Keep readingRushdie Confronts a World Where Principles Are Dying

Knife is a curiously one-eyed book, in a metaphorical, as well as a literal sense.

Keep readingEurope Is Going New Punk

European voters — especially young voters — are moving firmly to the right.

Keep readingThe BFD News Quiz

Are you an avid reader of The BFD? Take our News quiz to find out how much information you can recall from our articles published this week.

Keep readingThe Increase in Cancer Deaths

Whilst reduced cancer screening and care due to lockdown may explain increased cancer deaths, clearly it does not explain why six specific types of cancer increased with statistical…

Keep readingThe BFD Daily Opinion Poll

Take our Daily Opinion Poll and see how your views compare to other readers and then share the poll on social media.

Keep readingBecoming an Orphan as an Adult

The finality of losing a parent is difficult to comprehend. Your parents (or parent) have always been there; a part of your life. Your Dad and/or your Mum…

Keep readingDoes Culture Matter More Than Care?

One of reasons Oranga Tamariki exists is to prevent child neglect. But could the organisation itself be guilty of the same?

Keep readingLuxon Needs to Wake Up

Both Melissa Lee and Penny Simmonds have been stitched up by officials whispering in the ear of the Prime Minister, who naively assumes people are telling him the…

Keep readingLuxon’s Show of Strength Is Perfect for Our Era

Removing ministers for poor performance after only five months in the job just doesn’t normally happen in politics.

Keep readingMake Your Mind up Willie

Willie Jackson is a motor mouth with a poor memory. Just a few weeks ago he was attacking Melissa Lee and calling her ‘useless’, ‘stupid’ and ‘incompetent’, and…

Keep reading